-

From oil spills to new species: how tech reveals the ocean

From oil spills to new species: how tech reveals the ocean

-

Former sex worker records Tokyo's red-light history

-

Most Asian markets rise on hopes for bill to avert US shutdown

Most Asian markets rise on hopes for bill to avert US shutdown

-

Renowned US health research hub Johns Hopkins to slash 2,000 jobs

-

You're kidding! Prince William reveals Aston Villa superstitions

You're kidding! Prince William reveals Aston Villa superstitions

-

Top US university says ending 2,000 positions due to Trump cuts

-

Stock markets tumble as Trump targets booze

Stock markets tumble as Trump targets booze

-

Sea levels rise by 'unexpected' amount in 2024: NASA

-

Trump tariff threat leaves sour taste for European drinks producers

Trump tariff threat leaves sour taste for European drinks producers

-

Ex-NOAA chief: Trump firings put lives, jobs, and science in jeopardy

-

Spain to face increasingly 'severe' droughts: report

Spain to face increasingly 'severe' droughts: report

-

Georgian designer Demna leaves Balenciaga for Gucci

-

Diet puts Greenland Inuit at risk from 'forever chemicals': study

Diet puts Greenland Inuit at risk from 'forever chemicals': study

-

'Blood Moon' rising: Rare total lunar eclipse tonight

-

Donatella Versace, fashion icon who saved slain brother's brand

Donatella Versace, fashion icon who saved slain brother's brand

-

Sweden to hold talks on countering soaring food costs

-

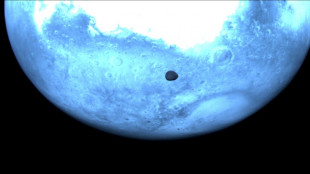

Asteroid probe snaps rare pics of Martian moon

Asteroid probe snaps rare pics of Martian moon

-

EU, US eye greater energy ties amid Trump frictions

-

Donatella Versace to give up creative reins of brand after 28 years

Donatella Versace to give up creative reins of brand after 28 years

-

Stock markets find little cheer as Trump targets champagne

-

UK seeks tougher term for father jailed over daughter's murder

UK seeks tougher term for father jailed over daughter's murder

-

Kyrgyzstan, Tajikistan sign border deal to boost regional stability

-

First brown bear to have brain surgery emerges from hibernation

First brown bear to have brain surgery emerges from hibernation

-

Iraq says seeking alternatives to Iran gas

-

Food app Deliveroo delivers first annual profit

Food app Deliveroo delivers first annual profit

-

Less mapped than the Moon: quest to reveal the seabed

-

Couche-Tard bosses make case in Tokyo for 7-Eleven buyout

Couche-Tard bosses make case in Tokyo for 7-Eleven buyout

-

Australia tells US influencer: 'leave baby wombat alone'

-

'Sound science' must guide deep-sea mining: top official

'Sound science' must guide deep-sea mining: top official

-

Asian stocks wobble as US inflation fails to ease trade worries

-

Trump's Canada fixation: an expansionist dream

Trump's Canada fixation: an expansionist dream

-

Generative AI rivals racing to the future

-

DeepSeek dims shine of AI stars

DeepSeek dims shine of AI stars

-

Americas to witness rare 'Blood Moon' total lunar eclipse

-

More wait for stranded astronauts after replacement crew delayed

More wait for stranded astronauts after replacement crew delayed

-

Argentine football fans, protesters clash with police at pensions march

-

Monopoly Go game maker Scopely to buy Pokemon Go team

Monopoly Go game maker Scopely to buy Pokemon Go team

-

Detained pro-Palestinian activist denied legal calls, lawyer tells US court

-

Greenland to get new govt to lead independence process

Greenland to get new govt to lead independence process

-

Meet 'Pink', the new face of human evolution in Europe

-

S.Africa revised budget gets booed despite smaller tax hike

S.Africa revised budget gets booed despite smaller tax hike

-

Stocks advance on US inflation slowing, Ukraine ceasefire plan

-

Shares in Zara owner Inditex sink despite record profit

Shares in Zara owner Inditex sink despite record profit

-

US consumer inflation cools slightly as tariff worries flare

-

Greenland to get new government to lead independence process

Greenland to get new government to lead independence process

-

Stocks diverge over Trump tariffs, Ukraine ceasefire plan

-

Battery maker Northvolt files for bankruptcy in Sweden

Battery maker Northvolt files for bankruptcy in Sweden

-

Markets mixed as Trump trade policy sows uncertainty

-

'Stranded' astronauts closer to coming home after next ISS launch

'Stranded' astronauts closer to coming home after next ISS launch

-

Thailand sacks senior cop over illicit gambling, fraud

Asian stocks wobble as US inflation fails to ease trade worries

Asian investors struggled Thursday to build on much-needed gains on Wall Street as a below-forecast read on US inflation was offset by ongoing concerns about President Donald Trump's trade war.

With governments around the world trying to figure out how to respond to the US president's tariffs agenda and threats of further measures, equity markets have been plunged into turmoil amid uncertainty about what is to come.

While attention has been mostly on the trade saga in recent weeks, Wednesday provided a little relief as data showed US consumer inflation slowed slightly more than expected in February -- the first full month of Trump's second term.

The report also revealed core inflation, which excludes volatile food and energy prices, had come in below consensus.

The figures helped temper some worries about a recent uptick in prices.

However, National Australia Bank's Tapas Strickland said it was "worth noting the data was for February and thus largely pre-dates any potential tariff impacts".

There has been a growing concern among investors that Trump's tariffs and pledges to slash taxes, regulations and immigration would reignite inflation, force the Federal Reserve to hike interest rates again and cause a recession.

And Stephen Innes at SPI Asset Management warned that while markets reacted positively to the consumer price readings, there was still a lot of uncertainty in markets.

"Let's be clear, this isn't a free pass to rally unchallenged. The real question now is how far Trump is willing to push on tariffs and government cuts," he wrote in a commentary.

"With April 2's reciprocal tariff D-Day looming, traders would be foolish to dismiss his resolve to rewrite global trade," he added, referring to another round of levies due to come into effect.

"If the past few weeks have proven anything, his tolerance for the 'pain trade' (US stocks lower) is far higher than the market assumed."

In early Asian trade, markets moved in a tight range.

Hong Kong, Sydney, Singapore, Wellington and Jakarta fell while Tokyo, Shanghai, Seoul, Taipei and Manila rose.

Mark Hackett at Nationwide said "for the last three weeks, traders have felt like buying this market is like trying to catch a falling knife".

Focus is also turning to developments in the Ukraine crisis after Kyiv endorsed a US proposal for a 30-day ceasefire, with Washington saying it wants Russia to agree to an unconditional halt to hostilities.

The Kremlin said it was awaiting details of the US proposal and gave no indication of its readiness to stop fighting but Trump warned "devastating" sanctions were possible if Russian President Vladimir Putin refused an agreement.

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: UP 1.0 percent at 37,173.82 (break)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 23,587.34

Shanghai - Composite: UP 0.1 percent at 3,373.87

Euro/dollar: UP at $1.0896 from $1.0890 on Wednesday

Pound/dollar: UP at $1.2972 from $1.2969

Dollar/yen: DOWN at 148.17 yen from 148.32 yen

Euro/pound: UP at 83.99 pence from 83.97 pence

West Texas Intermediate: DOWN 0.2 percent at $67.54 per barrel

Brent North Sea Crude: DOWN 0.1 percent at $70.85 per barrel

New York - Dow: DOWN 0.2 percent at 41,350.93 points (close)

London - FTSE 100: UP 0.5 percent at 8,540.97 (close)

A.Agostinelli--CPN