-

UN chief promises to do "everything" to avoid food cuts to Rohingyas in Bangladesh

UN chief promises to do "everything" to avoid food cuts to Rohingyas in Bangladesh

-

UniCredit gets ECB nod on Commerzbank stake, but delays merger decision

-

Sri Lanka adjusts train timings to tackle elephant deaths

Sri Lanka adjusts train timings to tackle elephant deaths

-

BMW expects big hit from tariffs after 2024 profits plunge

-

Gold tops $3,000 for first time on Trump tariff threats

Gold tops $3,000 for first time on Trump tariff threats

-

UK energy minister heads to China to talk climate

-

Syrian Druze cross armistice line for pilgrimage to Israel

Syrian Druze cross armistice line for pilgrimage to Israel

-

UN chief in Rohingya refugee camp solidarity visit

-

Taiwan tech giant Foxconn's 2024 profit misses forecasts

Taiwan tech giant Foxconn's 2024 profit misses forecasts

-

UniCredit gets ECB nod for Commerzbank stake

-

BMW warns on tariffs, China as 2024 profits plunge

BMW warns on tariffs, China as 2024 profits plunge

-

Driving ban puts brakes on young women in Turkmenistan

-

Stargazers marvel at 'Blood Moon', rare total lunar eclipse

Stargazers marvel at 'Blood Moon', rare total lunar eclipse

-

Peaceful Czechs grapple with youth violence

-

From oil spills to new species: how tech reveals the ocean

From oil spills to new species: how tech reveals the ocean

-

Former sex worker records Tokyo's red-light history

-

Most Asian markets rise on hopes for bill to avert US shutdown

Most Asian markets rise on hopes for bill to avert US shutdown

-

Renowned US health research hub Johns Hopkins to slash 2,000 jobs

-

You're kidding! Prince William reveals Aston Villa superstitions

You're kidding! Prince William reveals Aston Villa superstitions

-

Top US university says ending 2,000 positions due to Trump cuts

-

Stock markets tumble as Trump targets booze

Stock markets tumble as Trump targets booze

-

Sea levels rise by 'unexpected' amount in 2024: NASA

-

Trump tariff threat leaves sour taste for European drinks producers

Trump tariff threat leaves sour taste for European drinks producers

-

Ex-NOAA chief: Trump firings put lives, jobs, and science in jeopardy

-

Spain to face increasingly 'severe' droughts: report

Spain to face increasingly 'severe' droughts: report

-

Georgian designer Demna leaves Balenciaga for Gucci

-

Diet puts Greenland Inuit at risk from 'forever chemicals': study

Diet puts Greenland Inuit at risk from 'forever chemicals': study

-

'Blood Moon' rising: Rare total lunar eclipse tonight

-

Donatella Versace, fashion icon who saved slain brother's brand

Donatella Versace, fashion icon who saved slain brother's brand

-

Sweden to hold talks on countering soaring food costs

-

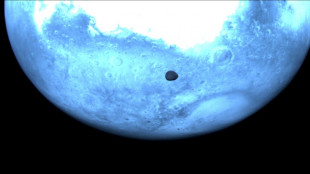

Asteroid probe snaps rare pics of Martian moon

Asteroid probe snaps rare pics of Martian moon

-

EU, US eye greater energy ties amid Trump frictions

-

Donatella Versace to give up creative reins of brand after 28 years

Donatella Versace to give up creative reins of brand after 28 years

-

Stock markets find little cheer as Trump targets champagne

-

UK seeks tougher term for father jailed over daughter's murder

UK seeks tougher term for father jailed over daughter's murder

-

Kyrgyzstan, Tajikistan sign border deal to boost regional stability

-

First brown bear to have brain surgery emerges from hibernation

First brown bear to have brain surgery emerges from hibernation

-

Iraq says seeking alternatives to Iran gas

-

Food app Deliveroo delivers first annual profit

Food app Deliveroo delivers first annual profit

-

Less mapped than the Moon: quest to reveal the seabed

-

Couche-Tard bosses make case in Tokyo for 7-Eleven buyout

Couche-Tard bosses make case in Tokyo for 7-Eleven buyout

-

Australia tells US influencer: 'leave baby wombat alone'

-

'Sound science' must guide deep-sea mining: top official

'Sound science' must guide deep-sea mining: top official

-

Asian stocks wobble as US inflation fails to ease trade worries

-

Trump's Canada fixation: an expansionist dream

Trump's Canada fixation: an expansionist dream

-

Generative AI rivals racing to the future

-

DeepSeek dims shine of AI stars

DeepSeek dims shine of AI stars

-

Americas to witness rare 'Blood Moon' total lunar eclipse

-

More wait for stranded astronauts after replacement crew delayed

More wait for stranded astronauts after replacement crew delayed

-

Argentine football fans, protesters clash with police at pensions march

Stock markets find little cheer as Trump targets champagne

Global stock markets mostly slid on Thursday as US President Donald Trump launched a new volley in his trade war and hopes for a quick Ukraine ceasefire faded.

Worries about a potential US government shutdown at the weekend also weighed on sentiment.

Trump threatened Thursday to impose 200-percent tariffs on wine, champagne and other alcoholic products from France and other European Union countries in retaliation against the bloc's planned levies on US-produced whiskey, part of the EU's reprisals for US tariffs on steel and aluminium imports.

Trump has launched trade wars against competitors and partners alike since taking office, wielding tariffs as a tool to pressure countries on commerce and other policy issues.

Shares in luxury giant LVMH, which owns several champagne houses including Dom Perignon and Hennessy cognac, fell 1.4 percent in afternoon trading.

Shares in French drinks group Pernod Ricard, which owns two champagne houses and Jameson Irish Whiskey, tumbled 3.4 percent.

The Paris stock exchange was 0.4 percent lower in afternoon trading and Frankfurt shed 0.5 percent. London bucked the trend, edging less than a tenth of a percentage point higher.

Wall Street opened lower with the Dow giving up 0.3 percent.

The drop came despite data showing US producer inflation was flat in February, defying expectations of an uptick as Trump's tariff hikes targeting Chinese goods took effect.

David Morrison, senior market analyst at Trade Nation, said cool inflation data would normally spark a rally, but that investors remain wary.

"The problem is President Trump's tariff strategy, which appears indiscriminate, poorly targeted and inconsistent," he said.

"It's proving difficult to fathom the endgame. Is it about border control, making America great again, replacing income tax with levies on imports, all of the above, or none?"

Traders were meanwhile waiting on a decision from Russia on whether to mirror Ukraine's acceptance of a 30-day ceasefire as proposed by the United States.

"Investors remain on the edge of their seat as they weigh up the impact of tariffs and whether ceasefire talks will yield an agreement between Russia and Ukraine," noted Russ Mould, investment director at AJ Bell.

Trump's special envoy Steve Witkoff, who arrived in Moscow, could possibly meet Russian leader Vladimir Putin, according to a Kremlin aide.

But comments by Russian officials ahead of Witkoff's arrival that a temporary truce with Ukraine was not in Moscow's interest dampened hopes for a quick breakthrough.

Gold, seen as a safe-haven investment, came close to reaching a new record high.

Trump's programme of tariffs and pledges to slash taxes, regulations and immigration has sparked market volatility and concerns that the measures could reignite inflation.

This in turn could force the Federal Reserve to hike interest rates again and cause a recession.

Analysts pointed out that the latest US inflation figures, while welcome, had to be taken in context.

National Australia Bank's Tapas Strickland said it was "worth noting the data was for February and thus largely pre-dates any potential tariff impacts".

- Key figures around 1330 GMT -

New York - Dow: DOWN 0.3 percent at 41,220.43 points

New York - S&P 500: DOWN 0.2 percent at 5,587.50

New York - Nasdaq Composite: DOWN 0.3 percent at 17,597.07

London - FTSE 100: UP less than 0.1 percent at 8,547.99

Paris - CAC 40: DOWN 0.4 percent at 7,953.59

Frankfurt - DAX: DOWN 0.5 percent at 22,570.10

Tokyo - Nikkei 225: DOWN 0.1 percent at 36,790.03 (close)

Hong Kong - Hang Seng Index: DOWN 0.6 percent at 23,462.65 (close)

Shanghai - Composite: DOWN 0.4 percent at 3,358.73 (close)

Euro/dollar: DOWN at $1.0838 from $1.0890 on Wednesday

Pound/dollar: DOWN at $1.2928 from $1.2969

Dollar/yen: DOWN at 148.19 yen from 148.32 yen

Euro/pound: DOWN at 83.83 pence from 83.97 pence

West Texas Intermediate: DOWN 0.9 percent at $67.07 per barrel

Brent North Sea Crude: DOWN 0.8 percent at $70.37 per barrel

burs-rl/lth

M.Anderson--CPN