-

UN chief promises to do "everything" to avoid food cuts to Rohingyas in Bangladesh

UN chief promises to do "everything" to avoid food cuts to Rohingyas in Bangladesh

-

UniCredit gets ECB nod on Commerzbank stake, but delays merger decision

-

Sri Lanka adjusts train timings to tackle elephant deaths

Sri Lanka adjusts train timings to tackle elephant deaths

-

BMW expects big hit from tariffs after 2024 profits plunge

-

Gold tops $3,000 for first time on Trump tariff threats

Gold tops $3,000 for first time on Trump tariff threats

-

UK energy minister heads to China to talk climate

-

Syrian Druze cross armistice line for pilgrimage to Israel

Syrian Druze cross armistice line for pilgrimage to Israel

-

UN chief in Rohingya refugee camp solidarity visit

-

Taiwan tech giant Foxconn's 2024 profit misses forecasts

Taiwan tech giant Foxconn's 2024 profit misses forecasts

-

UniCredit gets ECB nod for Commerzbank stake

-

BMW warns on tariffs, China as 2024 profits plunge

BMW warns on tariffs, China as 2024 profits plunge

-

Driving ban puts brakes on young women in Turkmenistan

-

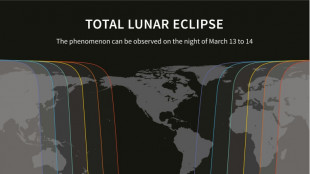

Stargazers marvel at 'Blood Moon', rare total lunar eclipse

Stargazers marvel at 'Blood Moon', rare total lunar eclipse

-

Peaceful Czechs grapple with youth violence

-

From oil spills to new species: how tech reveals the ocean

From oil spills to new species: how tech reveals the ocean

-

Former sex worker records Tokyo's red-light history

-

Most Asian markets rise on hopes for bill to avert US shutdown

Most Asian markets rise on hopes for bill to avert US shutdown

-

Renowned US health research hub Johns Hopkins to slash 2,000 jobs

-

You're kidding! Prince William reveals Aston Villa superstitions

You're kidding! Prince William reveals Aston Villa superstitions

-

Top US university says ending 2,000 positions due to Trump cuts

-

Stock markets tumble as Trump targets booze

Stock markets tumble as Trump targets booze

-

Sea levels rise by 'unexpected' amount in 2024: NASA

-

Trump tariff threat leaves sour taste for European drinks producers

Trump tariff threat leaves sour taste for European drinks producers

-

Ex-NOAA chief: Trump firings put lives, jobs, and science in jeopardy

-

Spain to face increasingly 'severe' droughts: report

Spain to face increasingly 'severe' droughts: report

-

Georgian designer Demna leaves Balenciaga for Gucci

-

Diet puts Greenland Inuit at risk from 'forever chemicals': study

Diet puts Greenland Inuit at risk from 'forever chemicals': study

-

'Blood Moon' rising: Rare total lunar eclipse tonight

-

Donatella Versace, fashion icon who saved slain brother's brand

Donatella Versace, fashion icon who saved slain brother's brand

-

Sweden to hold talks on countering soaring food costs

-

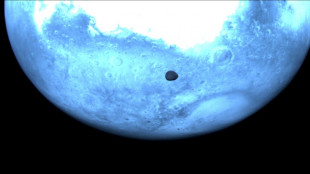

Asteroid probe snaps rare pics of Martian moon

Asteroid probe snaps rare pics of Martian moon

-

EU, US eye greater energy ties amid Trump frictions

-

Donatella Versace to give up creative reins of brand after 28 years

Donatella Versace to give up creative reins of brand after 28 years

-

Stock markets find little cheer as Trump targets champagne

-

UK seeks tougher term for father jailed over daughter's murder

UK seeks tougher term for father jailed over daughter's murder

-

Kyrgyzstan, Tajikistan sign border deal to boost regional stability

-

First brown bear to have brain surgery emerges from hibernation

First brown bear to have brain surgery emerges from hibernation

-

Iraq says seeking alternatives to Iran gas

-

Food app Deliveroo delivers first annual profit

Food app Deliveroo delivers first annual profit

-

Less mapped than the Moon: quest to reveal the seabed

-

Couche-Tard bosses make case in Tokyo for 7-Eleven buyout

Couche-Tard bosses make case in Tokyo for 7-Eleven buyout

-

Australia tells US influencer: 'leave baby wombat alone'

-

'Sound science' must guide deep-sea mining: top official

'Sound science' must guide deep-sea mining: top official

-

Asian stocks wobble as US inflation fails to ease trade worries

-

Trump's Canada fixation: an expansionist dream

Trump's Canada fixation: an expansionist dream

-

Generative AI rivals racing to the future

-

DeepSeek dims shine of AI stars

DeepSeek dims shine of AI stars

-

Americas to witness rare 'Blood Moon' total lunar eclipse

-

More wait for stranded astronauts after replacement crew delayed

More wait for stranded astronauts after replacement crew delayed

-

Argentine football fans, protesters clash with police at pensions march

Most Asian markets rise on hopes for bill to avert US shutdown

Asian investors fought Friday to grind out gains at the end of a painful week for markets as they welcomed signs US lawmakers will avert a government shutdown but remained fearful over Donald Trump's trade war.

Equities have been pummelled in recent weeks and gold pushed to a record high by concerns about a US recession as the president hammers trading partners with swingeing tariffs while billionaire ally Elon Musk slashes federal jobs at home.

In the latest salvo, Trump threatened to impose 200 percent tariffs on wine, champagne and other alcoholic beverages from European Union countries in retaliation against the bloc's planned levies on American-made whiskey.

The European measures -- including a 50 percent tariff on American whiskey -- were in response to the White House's levies on steel and alumium imports.

"If this Tariff is not removed immediately, the U.S. will shortly place a 200% Tariff on all WINES, CHAMPAGNES, & ALCOHOLIC PRODUCTS COMING OUT OF FRANCE AND OTHER E.U. REPRESENTED COUNTRIES," Trump posted on his Truth Social platform.

He also said he would not row back on the metals duties, nor plans for sweeping reciprocal tariffs on global partners that are due to kick in as soon as April 2.

Observers have warned that markets are being wracked by uncertainty amid fears the increasing trade war between major global economies could reignite inflation, with many investors worrying about a possible recession in the United States.

Wall Street has been hammered, with the S&P 500 slipping into a correction Thursday having fallen more than 10 percent from its recent peak -- a record high touched just last month.

Gold, a haven in times of turmoil, hit a record of $2,990.21 Friday owing to a rush into safety.

However, Asian markets enjoyed a broadly positive Friday amid hopes Congress will pass a bill to avert a painful government shutdown.

With just hours until a deadline to push a Republic spending bill through, Senate Democratic leader Chuck Schumer dropped his threat to block it.

The package would keep the lights on through September, but Democrats have come under pressure from their grassroots to defy a plan they say is full of harmful spending cuts.

Schumer claimed Trump and Musk -- who runs the Department of Government Efficiency (DOGE) that has gutted various key departments -- were hoping for the government to grind to a halt.

"A shutdown would give Donald Trump and Elon Musk carte blanche to destroy vital government services at a significantly faster rate than they can right now... with nobody left at the agencies to check them," he warned.

Hong Kong rose more than one percent, recouping some of the losses suffered over the week.

However, major conglomerate CK Hutchison Holdings -- owned by tycoon Li Ka-shing -- sank seven percent after Chinese officials in Hong Kong reposted an attack on the firm over its sale of a controlling stake in Panama ports under pressure from Trump.

It had surged 25 percent earlier this month after the sale.

Shanghai, Tokyo, Wellington and Manila also advanced. There were losses in Singapore, Seoul, Taipei and Jakarta.

Chris Beauchamp, chief market analyst at IG, said a US government shutdown could be costly.

"The 2018-2019 shutdown... resulted in an estimated $11 billion loss to the US economy, with $3 billion considered permanent," he wrote in a note.

"Current market participants are clearly factoring in similar potential damage if lawmakers fail to reach an agreement.

"A government shutdown, combined with existing trade tensions and tariffs, could exacerbate market volatility. Investors are already concerned about the economic impact of ongoing tariffs, which have contributed to declines in major stock indices in recent sessions."

Dealers were also watching developments in Europe after Russian President Vladimir Putin said he had "serious questions" about Washington's plan for a 30-day ceasefire in Ukraine. However, he said he was ready to discuss it with his American counterpart.

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: UP 0.4 percent at 36,919.12 (break)

Hong Kong - Hang Seng Index: UP 1.4 percent at 23,787.84

Shanghai - Composite: UP 1.1 percent at 3,395.27

Euro/dollar: DOWN at $1.0836 from $1.0849 on Thursday

Pound/dollar: DOWN at $1.2939 from $1.2948

Dollar/yen: UP at 148.23 yen from 147.75 yen

Euro/pound: UP at 83.76 pence from 83.75 pence

West Texas Intermediate: UP 0.6 percent at $66.96 per barrel

Brent North Sea Crude: DOWN 0.6 percent at $70.27 per barrel

New York - Dow: DOWN 1.3 percent at 40,813.57 (close)

London - FTSE 100: FLAT at 8,542.56 (close)

H.Müller--CPN