-

Crew launch to ISS paves way for stranded astronauts' homecoming

Crew launch to ISS paves way for stranded astronauts' homecoming

-

Just looking at images of nature can relieve pain, study finds

-

UN chief promises to do "everything" to avoid food cuts to Rohingyas in Bangladesh

UN chief promises to do "everything" to avoid food cuts to Rohingyas in Bangladesh

-

UniCredit gets ECB nod on Commerzbank stake, but delays merger decision

-

Sri Lanka adjusts train timings to tackle elephant deaths

Sri Lanka adjusts train timings to tackle elephant deaths

-

BMW expects big hit from tariffs after 2024 profits plunge

-

Gold tops $3,000 for first time on Trump tariff threats

Gold tops $3,000 for first time on Trump tariff threats

-

UK energy minister heads to China to talk climate

-

Syrian Druze cross armistice line for pilgrimage to Israel

Syrian Druze cross armistice line for pilgrimage to Israel

-

UN chief in Rohingya refugee camp solidarity visit

-

Taiwan tech giant Foxconn's 2024 profit misses forecasts

Taiwan tech giant Foxconn's 2024 profit misses forecasts

-

UniCredit gets ECB nod for Commerzbank stake

-

BMW warns on tariffs, China as 2024 profits plunge

BMW warns on tariffs, China as 2024 profits plunge

-

Driving ban puts brakes on young women in Turkmenistan

-

Stargazers marvel at 'Blood Moon', rare total lunar eclipse

Stargazers marvel at 'Blood Moon', rare total lunar eclipse

-

Peaceful Czechs grapple with youth violence

-

From oil spills to new species: how tech reveals the ocean

From oil spills to new species: how tech reveals the ocean

-

Former sex worker records Tokyo's red-light history

-

Most Asian markets rise on hopes for bill to avert US shutdown

Most Asian markets rise on hopes for bill to avert US shutdown

-

Renowned US health research hub Johns Hopkins to slash 2,000 jobs

-

You're kidding! Prince William reveals Aston Villa superstitions

You're kidding! Prince William reveals Aston Villa superstitions

-

Top US university says ending 2,000 positions due to Trump cuts

-

Stock markets tumble as Trump targets booze

Stock markets tumble as Trump targets booze

-

Sea levels rise by 'unexpected' amount in 2024: NASA

-

Trump tariff threat leaves sour taste for European drinks producers

Trump tariff threat leaves sour taste for European drinks producers

-

Ex-NOAA chief: Trump firings put lives, jobs, and science in jeopardy

-

Spain to face increasingly 'severe' droughts: report

Spain to face increasingly 'severe' droughts: report

-

Georgian designer Demna leaves Balenciaga for Gucci

-

Diet puts Greenland Inuit at risk from 'forever chemicals': study

Diet puts Greenland Inuit at risk from 'forever chemicals': study

-

'Blood Moon' rising: Rare total lunar eclipse tonight

-

Donatella Versace, fashion icon who saved slain brother's brand

Donatella Versace, fashion icon who saved slain brother's brand

-

Sweden to hold talks on countering soaring food costs

-

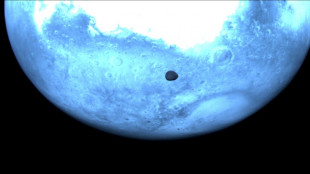

Asteroid probe snaps rare pics of Martian moon

Asteroid probe snaps rare pics of Martian moon

-

EU, US eye greater energy ties amid Trump frictions

-

Donatella Versace to give up creative reins of brand after 28 years

Donatella Versace to give up creative reins of brand after 28 years

-

Stock markets find little cheer as Trump targets champagne

-

UK seeks tougher term for father jailed over daughter's murder

UK seeks tougher term for father jailed over daughter's murder

-

Kyrgyzstan, Tajikistan sign border deal to boost regional stability

-

First brown bear to have brain surgery emerges from hibernation

First brown bear to have brain surgery emerges from hibernation

-

Iraq says seeking alternatives to Iran gas

-

Food app Deliveroo delivers first annual profit

Food app Deliveroo delivers first annual profit

-

Less mapped than the Moon: quest to reveal the seabed

-

Couche-Tard bosses make case in Tokyo for 7-Eleven buyout

Couche-Tard bosses make case in Tokyo for 7-Eleven buyout

-

Australia tells US influencer: 'leave baby wombat alone'

-

'Sound science' must guide deep-sea mining: top official

'Sound science' must guide deep-sea mining: top official

-

Asian stocks wobble as US inflation fails to ease trade worries

-

Trump's Canada fixation: an expansionist dream

Trump's Canada fixation: an expansionist dream

-

Generative AI rivals racing to the future

-

DeepSeek dims shine of AI stars

DeepSeek dims shine of AI stars

-

Americas to witness rare 'Blood Moon' total lunar eclipse

UniCredit gets ECB nod on Commerzbank stake, but delays merger decision

Italian banking giant UniCredit said Friday it had secured approval from the European Central Bank to up its stake in Commerzbank, but warned there were still hurdles ahead before a possible takeover of its German rival.

The ECB, which supervises the banking system in the European Union's shared currency zone, agreed that the Italian lender could buy up to 29.9 percent of Commerzbank, UniCredit said in a statement.

Yet the bank said it would take longer than initially expected to make a decision on a potential takeover, which both Commerzbank and Berlin oppose, with the timeline "now likely to extend well beyond the end of 2025".

Commerzbank has vowed to fight any takeover, and UniCredit's approach has angered German politicians, including outgoing Chancellor Olaf Scholz and his likely successor, Friedrich Merz, whose conservatives won elections last month.

UniCredit, Italy's second largest bank, said Friday it was "awaiting the opportunity to initiate a constructive dialogue with the new German government once formed".

The saga began in September when UniCredit revealed it had built up a stake in its rival, triggering talk that chief executive Andrea Orcel wanted to push for an ambitious pan-European banking merger.

UniCredit has since boosted its holding in Germany's second-biggest bank to around 28 percent, 18.5 percent of which is held through derivatives, a form of financial contract.

A spokeswoman for the German government said the ECB decision did not change the position of Berlin, which supports Commerzbank's autonomy.

"The government has also repeatedly reiterated its rejection of a haphazard and hostile approach, and considers that hostile takeovers in the banking sector are not appropriate," she said.

- Still many factors -

Commerzbank also said the ECB's green light Friday "does not change the fundamental situation: UniCredit continues to be a shareholder of Commerzbank".

"We are convinced of our strategy, which aims for profitable growth and value increase, and we are focusing on its successful implementation," it said.

Last month, Commerzbank announced it planned to cut about 3,900 jobs -- around 10 percent of its workforce -- and hiked its financial targets, in a bid to boost its share price and bolster its defences against its Italian suitor.

The job cuts, to be implemented by 2028, come after the lender booked a record profit in 2024.

UniCredit on Friday welcomed "some positive change at Commerzbank, which, together with the recent more optimistic view on German macro (economy), has driven a substantial increase in the bank share price".

Commerzbank's shares have almost doubled in price since UniCredit's move in September.

"However, only significant time will reveal if the plan is executable and hence determine whether such price appreciation is justified and sustainable," the Italian bank said.

UniCredit said the ECB authorisation underscored its own "financial strength and regulatory compliance" but said there were "still many factors" that will determine its plans on Commerzbank.

"Several further approvals are still required before the around 18.5 percent shares held through derivatives can be converted into physical shares, including from the Germany Federal Cartel Office," it said.

Orcel said in January he would not rush a takeover, and was willing to walk away, but would wait until the outcome of Germany's elections.

Berlin still holds a 12-percent stake in the lender, the legacy of a government bailout during the 2008 global financial crisis.

Merz, who is in talks to form a coalition government after the February vote, described a possible bid for Commerzbank as "hostile" in an interview with The Economist magazine last month.

However, some EU policymakers have backed the idea of a tie-up, saying it would create a heavyweight better able to compete internationally.

P.Petrenko--CPN