-

New nationwide blackout hits Cuba, officials say

New nationwide blackout hits Cuba, officials say

-

Meta strives to stifle ex-employee memoir

-

US Congress clears key hurdle in bid to avert govt shutdown

US Congress clears key hurdle in bid to avert govt shutdown

-

Gold tops $3,000 for first time on Trump tariff war, stocks rebound

-

Crew launch to ISS paves way for 'stranded' astronauts' return

Crew launch to ISS paves way for 'stranded' astronauts' return

-

Sean 'Diddy' Combs pleads not guilty to new indictment

-

Putin, Maduro vow to boost ties in wake of Trump sanctions

Putin, Maduro vow to boost ties in wake of Trump sanctions

-

Dozens evacuated in Italy's flood-hit Tuscany

-

Gold tops $3,000 for first time on Trump tariff threats; stocks rebound

Gold tops $3,000 for first time on Trump tariff threats; stocks rebound

-

US govt shutdown in balance after top Democrat avoids fight

-

Crew launch to ISS paves way for stranded astronauts' homecoming

Crew launch to ISS paves way for stranded astronauts' homecoming

-

Just looking at images of nature can relieve pain, study finds

-

UN chief promises to do "everything" to avoid food cuts to Rohingyas in Bangladesh

UN chief promises to do "everything" to avoid food cuts to Rohingyas in Bangladesh

-

UniCredit gets ECB nod on Commerzbank stake, but delays merger decision

-

Sri Lanka adjusts train timings to tackle elephant deaths

Sri Lanka adjusts train timings to tackle elephant deaths

-

BMW expects big hit from tariffs after 2024 profits plunge

-

Gold tops $3,000 for first time on Trump tariff threats

Gold tops $3,000 for first time on Trump tariff threats

-

UK energy minister heads to China to talk climate

-

Syrian Druze cross armistice line for pilgrimage to Israel

Syrian Druze cross armistice line for pilgrimage to Israel

-

UN chief in Rohingya refugee camp solidarity visit

-

Taiwan tech giant Foxconn's 2024 profit misses forecasts

Taiwan tech giant Foxconn's 2024 profit misses forecasts

-

UniCredit gets ECB nod for Commerzbank stake

-

BMW warns on tariffs, China as 2024 profits plunge

BMW warns on tariffs, China as 2024 profits plunge

-

Driving ban puts brakes on young women in Turkmenistan

-

Stargazers marvel at 'Blood Moon', rare total lunar eclipse

Stargazers marvel at 'Blood Moon', rare total lunar eclipse

-

Peaceful Czechs grapple with youth violence

-

From oil spills to new species: how tech reveals the ocean

From oil spills to new species: how tech reveals the ocean

-

Former sex worker records Tokyo's red-light history

-

Most Asian markets rise on hopes for bill to avert US shutdown

Most Asian markets rise on hopes for bill to avert US shutdown

-

Renowned US health research hub Johns Hopkins to slash 2,000 jobs

-

You're kidding! Prince William reveals Aston Villa superstitions

You're kidding! Prince William reveals Aston Villa superstitions

-

Top US university says ending 2,000 positions due to Trump cuts

-

Stock markets tumble as Trump targets booze

Stock markets tumble as Trump targets booze

-

Sea levels rise by 'unexpected' amount in 2024: NASA

-

Trump tariff threat leaves sour taste for European drinks producers

Trump tariff threat leaves sour taste for European drinks producers

-

Ex-NOAA chief: Trump firings put lives, jobs, and science in jeopardy

-

Spain to face increasingly 'severe' droughts: report

Spain to face increasingly 'severe' droughts: report

-

Georgian designer Demna leaves Balenciaga for Gucci

-

Diet puts Greenland Inuit at risk from 'forever chemicals': study

Diet puts Greenland Inuit at risk from 'forever chemicals': study

-

'Blood Moon' rising: Rare total lunar eclipse tonight

-

Donatella Versace, fashion icon who saved slain brother's brand

Donatella Versace, fashion icon who saved slain brother's brand

-

Sweden to hold talks on countering soaring food costs

-

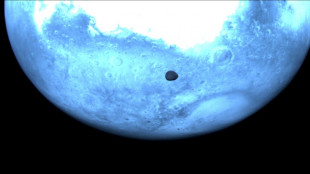

Asteroid probe snaps rare pics of Martian moon

Asteroid probe snaps rare pics of Martian moon

-

EU, US eye greater energy ties amid Trump frictions

-

Donatella Versace to give up creative reins of brand after 28 years

Donatella Versace to give up creative reins of brand after 28 years

-

Stock markets find little cheer as Trump targets champagne

-

UK seeks tougher term for father jailed over daughter's murder

UK seeks tougher term for father jailed over daughter's murder

-

Kyrgyzstan, Tajikistan sign border deal to boost regional stability

-

First brown bear to have brain surgery emerges from hibernation

First brown bear to have brain surgery emerges from hibernation

-

Iraq says seeking alternatives to Iran gas

Gold tops $3,000 for first time on Trump tariff war, stocks rebound

Gold rose above $3,000 for the first time Friday as President Donald Trump's trade wars boosted demand for safe-haven assets, while stock markets bounced on signs US lawmakers would avert a government shutdown.

Major US indices opened higher and remained in positive territory through the day, shrugging off a downcast reading on US consumer sentiment.

European stock markets were also given a lift after Germany moved closer to approving a massive infrastructure and defense spending program.

In Washington, hours before a deadline to push a Republican spending bill through, Senate Democratic leader Chuck Schumer dropped a threat to block it.

The package would keep the government operating through September, but Democrats had come under pressure from supporters to defy the plan, which they say is full of harmful spending cuts.

Stocks gained support from "a burgeoning sense that a government shutdown will be averted after Senator Schumer said he will vote for House-passed continuing resolution," said Patrick O'Hare, analyst at Briefing.com.

A consumer survey by the University of Michigan said expectations for the future "deteriorated," with "many consumers": citing a "high level of uncertainty around policy and other economic factors."

Paris and Frankfurt both rebounded after losses the previous day on US tariff threats.

Germany's likely next chancellor Friedrich Merz said his conservative party had struck a deal with the Greens on boosting defense and infrastructure spending, paving the way for the plan's approval in parliament.

"Germany is poised to pursue essential structural reforms while hoping for an end to the economic downturn," said Jochen Stanzl, an analyst at CMC Markets. "Investor sentiment shifted dramatically today."

- Times of uncertainty -

Gold, a haven in times of uncertainty, rose to as much as $3,004 an ounce before falling back to just under $3,000.

The precious metal was "boosted on increased haven demand amid trade war risks and recent stock market volatility", said Fawad Razaqzada, an analyst at City Index and Forex.com.

In the latest salvo, Trump threatened to impose 200 percent tariffs on wine, champagne and other alcoholic beverages from European Union countries.

Wall Street has been hammered in recent sessions by trade tensions, with the S&P 500 slipping into a technical correction Thursday, having fallen more than 10 percent from a record high it hit just last month.

The broad-based S&P 500 finished at 5,638.94, up 2.1 percent for the day, but down 2.3 percent for the week.

Some analysts warned that Friday's rebound would be short-lived.

"Recent rallies have run into a buzzsaw of selling pressure," said Nathan Peterson, an analyst at Charles Schwab. "Tariff escalations, a potential government shutdown, and persistent growth concerns due to trade policy make it difficult to sustain any kind of a bounce."

In company news, shares in Gucci-owner Kering plunged more than 11 percent in Paris as the group appointed a new creative director for its struggling flagship brand.

Shares in BMW were in the red as the German automaker warned that trade tensions between the United States, Europe and China would cost the company $1 billion this year.

- Key figures around 2040 GMT -

New York - Dow: Up 1.7 percent at 41,488.19 (close

New York - S&P 500: UP 2.1 percent at 5,638.94 (close)

New York - Nasdaq Composite: UP 2.6 percent at 17,754.09 (close)

London - FTSE 100: UP 1.1 percent at 8,632.33 (close)

Paris - CAC 40: UP 1.1 percent at 8,028.28 (close)

Frankfurt - DAX: UP 1.9 percent at 22,986.82 (close)

Tokyo - Nikkei 225: UP 0.7 percent at 37,053.10 (close)

Hong Kong - Hang Seng Index: UP 2.1 percent at 23,959.98 (close)

Shanghai - Composite: UP 1.8 percent at 3,419.56 (close)

Euro/dollar: UP at $1.0884 from $1.0852 on Thursday

Pound/dollar: DOWN at $1.2936 from $1.2952

Dollar/yen: UP at 148.62 yen from 147.81 yen

Euro/pound: UP at 84.14 pence from 83.79 pence

Brent North Sea Crude: UP 1.0 percent at $70.58 per barrel

West Texas Intermediate: UP 1.0 percent at $67.18 per barrel

T.Morelli--CPN