-

Malaysia's Silicon Valley ambitions face tough challenges

Malaysia's Silicon Valley ambitions face tough challenges

-

Asian markets mixed as geopolitics, trade wars deplete sentiment

-

Bank of Japan holds rates, warning of trade uncertainty

Bank of Japan holds rates, warning of trade uncertainty

-

Ice park threatened by climate change finds an ally in US silver mine

-

Bank of Japan expected to hold rates

Bank of Japan expected to hold rates

-

Smiles, thumbs ups and a safe return for 'stranded' NASA astronauts

-

'Stranded' NASA astronauts back on Earth after splashdown

'Stranded' NASA astronauts back on Earth after splashdown

-

US to produce tariff 'number' for countries on April 2: Bessent

-

'Stranded' ISS astronauts less than an hour from splashdown

'Stranded' ISS astronauts less than an hour from splashdown

-

Ghostly lunar sunsets shot by private lander

-

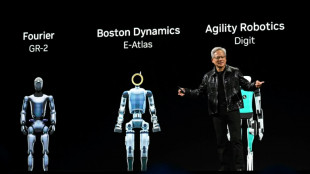

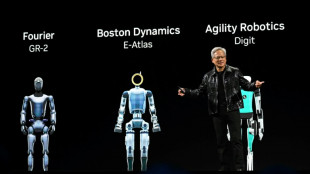

Nvidia showcases new tech at AI 'Super Bowl'

Nvidia showcases new tech at AI 'Super Bowl'

-

Ecuador battles spreading oil slick, residents without water

-

In high stakes move, Istanbul University revokes degree of top Erdogan rival

In high stakes move, Istanbul University revokes degree of top Erdogan rival

-

Trump admin moves to fire hundreds of government scientists

-

Turkey university cancels Erdogan rival's university degree

Turkey university cancels Erdogan rival's university degree

-

Homebound: 'Stranded' ISS astronauts now hours from splashdown

-

Germany's Siemens to cut over 6,000 jobs worldwide

Germany's Siemens to cut over 6,000 jobs worldwide

-

Hong Kong's bamboo scaffolds on their way out

-

Bessent says nations may avoid US reciprocal tariffs by halting unfair barriers

Bessent says nations may avoid US reciprocal tariffs by halting unfair barriers

-

Geopolitical tensions buffet markets

-

Google says to buy cybersecurity company Wiz for $32 bn

Google says to buy cybersecurity company Wiz for $32 bn

-

Huthis announce new attack on American warships, fresh US strikes

-

Markets track Wall St gains as tech inspires Hong Kong

Markets track Wall St gains as tech inspires Hong Kong

-

Historic fantasy 'Assassin's Creed' sparks bitter battles

-

Ivory Coast's epochal prehistoric finds pass unseen

Ivory Coast's epochal prehistoric finds pass unseen

-

Trump treatment of Columbia puts US universities on edge

-

Astronauts finally head home after unexpected nine-month ISS stay

Astronauts finally head home after unexpected nine-month ISS stay

-

Colombian influencer puts the pizzazz into recycling

-

German parliament to vote on huge spending boost for defence, infrastructure

German parliament to vote on huge spending boost for defence, infrastructure

-

China EV giant BYD soars after 5-minute charging platform unveiled

-

Asian markets track Wall St gains as tech inspires Hong Kong

Asian markets track Wall St gains as tech inspires Hong Kong

-

What happens to the human body in deep space?

-

Nvidia showcases AI chips as it shrugs off DeepSeek

Nvidia showcases AI chips as it shrugs off DeepSeek

-

Legalizing magic mushrooms under Trump? Psychedelic fans remain skeptical

-

Jury deliberates US pipeline case with free speech implications

Jury deliberates US pipeline case with free speech implications

-

European star-gazing agency says Chile green power plant will ruin its view

-

Astronauts finally to return after unexpected 9-month ISS stay

Astronauts finally to return after unexpected 9-month ISS stay

-

New blow to German auto sector as Audi announces job cuts

-

New Canada PM meets King Charles and Macron after Trump threats

New Canada PM meets King Charles and Macron after Trump threats

-

Hong Kong property tycoon Lee Shau-kee dies aged 97

-

Webb telescope directly observes exoplanet CO2 for first time

Webb telescope directly observes exoplanet CO2 for first time

-

Stench of death as Sudan army, paramilitaries battle for capital

-

'More and faster': UN calls to shrink buildings' carbon footprint

'More and faster': UN calls to shrink buildings' carbon footprint

-

US retail sales weaker than expected as consumer health under scrutiny

-

Court upholds £3 bn lifeline for UK's top water supplier

Court upholds £3 bn lifeline for UK's top water supplier

-

OECD lowers global growth projections over tariffs, uncertainty

-

Stock markets rise as China unveils consumer plan

Stock markets rise as China unveils consumer plan

-

Yemen's Huthis claim US aircraft carrier attacks

-

At least 40 killed in weekend US tornadoes

At least 40 killed in weekend US tornadoes

-

From determination to despair: S.Africa's youth battling for work

Bank of Japan expected to hold rates

The Bank of Japan is widely expected to keep interest rates unchanged in a Wednesday policy decision, with analysts pointing to economic uncertainty fuelled by US trade tariffs.

In January, the central bank hiked rates to their highest level in 17 years on the back of bumper inflation readings for the world's fourth largest economy.

But since then US President Donald Trump has imposed levies on multiple trading partners and imports including steel.

"I am worried about uncertainty regarding overseas economic and price trends," BoJ chief Kazuo Ueda told a parliament session last week when asked what concerned him the most.

Economists say bank officials are likely to keep the key interest rate at its current level of 0.5 percent when a two-day policy meeting concludes on Wednesday.

"With the dust still settling from January's rate hike... the BoJ will want to gauge the impact of recent monetary policy changes on the economy before making its next move," Stefan Angrick of Moody's Analytics wrote in a note last week.

"At the same time, a wave of tariff measures and threats from Washington have kept financial markets on edge, adding to the reasons for the BoJ to stand pat," he said.

SPI Asset Management's Stephen Innes said the US Federal Reserve and Bank of England were also expected to hold rates this week "as policymakers take their first collective pulse check on the fallout from Trump's trade policies".

The BoJ is gradually normalising its policies following years of aggressive monetary easing to try and jump-start the stagnant Japanese economy.

But headline Japanese inflation has been above the BoJ's two-percent target every month since April 2022, and a year ago the bank finally lifted its interest rates above zero, before increasing them to 0.25 percent in July.

The BoJ's Ueda said after the latest decision in January that the pace and timing of future increases would be decided after studying "the impact of this rate hike".

Wage trends are also key, after trade unions said early data showed they had secured an average 5.5 percent pay rise for members this year, a three-decade high and up from last year's preliminary reading of 5.3 percent.

"If the annual spring labour negotiations lead to significantly higher wages then we believe there is a possibility for an interest rate hike in the summer and another one six months later," Katsutoshi Inadome of SuMi TRUST said.

M.Davis--CPN