-

UniCredit CEO says prepared to wait on Commerzbank decision

UniCredit CEO says prepared to wait on Commerzbank decision

-

Santander to close one fifth of UK branches amid online switch

-

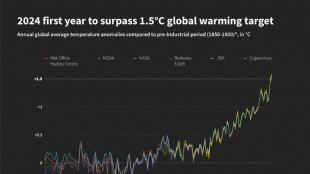

Record numbers forced to flee climate disasters: UN

Record numbers forced to flee climate disasters: UN

-

'Dark universe detective' telescope releases first data

-

Stock markets diverge, gold hits high tracking global unrest

Stock markets diverge, gold hits high tracking global unrest

-

China's Tencent sees profits surge as AI drive accelerates

-

Myanmar relief camps receive last WFP aid as cuts begin

Myanmar relief camps receive last WFP aid as cuts begin

-

Markets mixed as geopolitics, trade wars deplete sentiment

-

Bank of Japan holds rates and warns of trade uncertainty

Bank of Japan holds rates and warns of trade uncertainty

-

Uganda: the quiet power in the eastern DRC conflict

-

Tech firms fight to stem deepfake deluge

Tech firms fight to stem deepfake deluge

-

In US, a pastry chef attempts to crack an egg-free menu

-

Ecuador declares 'force majeure' emergency, cuts exports over oil spill

Ecuador declares 'force majeure' emergency, cuts exports over oil spill

-

Malaysia's Silicon Valley ambitions face tough challenges

-

Asian markets mixed as geopolitics, trade wars deplete sentiment

Asian markets mixed as geopolitics, trade wars deplete sentiment

-

Bank of Japan holds rates, warning of trade uncertainty

-

Ice park threatened by climate change finds an ally in US silver mine

Ice park threatened by climate change finds an ally in US silver mine

-

Bank of Japan expected to hold rates

-

International Management of Business Projects

International Management of Business Projects

-

His Highness Shaikh Mohammed Bin Sultan Bin Hamdan Al Nahyan Announces Strategic Partnership With Diginex (NASDAQ:DGNX)

-

Smiles, thumbs ups and a safe return for 'stranded' NASA astronauts

Smiles, thumbs ups and a safe return for 'stranded' NASA astronauts

-

'Stranded' NASA astronauts back on Earth after splashdown

-

US to produce tariff 'number' for countries on April 2: Bessent

US to produce tariff 'number' for countries on April 2: Bessent

-

'Stranded' ISS astronauts less than an hour from splashdown

-

Ghostly lunar sunsets shot by private lander

Ghostly lunar sunsets shot by private lander

-

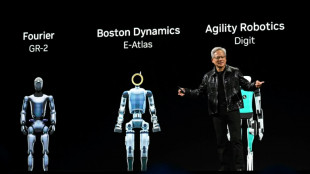

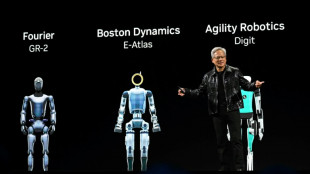

Nvidia showcases new tech at AI 'Super Bowl'

-

Ecuador battles spreading oil slick, residents without water

Ecuador battles spreading oil slick, residents without water

-

In high stakes move, Istanbul University revokes degree of top Erdogan rival

-

Trump admin moves to fire hundreds of government scientists

Trump admin moves to fire hundreds of government scientists

-

Turkey university cancels Erdogan rival's university degree

-

Homebound: 'Stranded' ISS astronauts now hours from splashdown

Homebound: 'Stranded' ISS astronauts now hours from splashdown

-

Germany's Siemens to cut over 6,000 jobs worldwide

-

Hong Kong's bamboo scaffolds on their way out

Hong Kong's bamboo scaffolds on their way out

-

Bessent says nations may avoid US reciprocal tariffs by halting unfair barriers

-

Geopolitical tensions buffet markets

Geopolitical tensions buffet markets

-

Google says to buy cybersecurity company Wiz for $32 bn

-

Huthis announce new attack on American warships, fresh US strikes

Huthis announce new attack on American warships, fresh US strikes

-

Markets track Wall St gains as tech inspires Hong Kong

-

Historic fantasy 'Assassin's Creed' sparks bitter battles

Historic fantasy 'Assassin's Creed' sparks bitter battles

-

Ivory Coast's epochal prehistoric finds pass unseen

-

Trump treatment of Columbia puts US universities on edge

Trump treatment of Columbia puts US universities on edge

-

Astronauts finally head home after unexpected nine-month ISS stay

-

Colombian influencer puts the pizzazz into recycling

Colombian influencer puts the pizzazz into recycling

-

German parliament to vote on huge spending boost for defence, infrastructure

-

China EV giant BYD soars after 5-minute charging platform unveiled

China EV giant BYD soars after 5-minute charging platform unveiled

-

Asian markets track Wall St gains as tech inspires Hong Kong

-

What happens to the human body in deep space?

What happens to the human body in deep space?

-

Nvidia showcases AI chips as it shrugs off DeepSeek

-

Legalizing magic mushrooms under Trump? Psychedelic fans remain skeptical

Legalizing magic mushrooms under Trump? Psychedelic fans remain skeptical

-

Jury deliberates US pipeline case with free speech implications

Stock markets diverge, gold hits high tracking global unrest

European and Asian stock markets traded mixed and gold hit another record high Wednesday as trade war worries cast a shadow and geopolitical concerns returned to the fore.

It followed Tuesday's tech-led losses on Wall Street.

The US Federal Reserve is widely expected to extend its rate cut pause Wednesday as it seeks to chart a path through the economic turbulence unleashed by Trump's ever-changing approach to tariffs.

The price of gold, seen as a safe-haven investment, struck a record high above $3,045 an ounce on fears of a fresh upsurge in hostilities in the Middle East after Israel launched its most intense strikes on Gaza since a ceasefire with Hamas took effect.

Oil prices dropped, however, as Hamas said it remained open to negotiations while calling for pressure on Israel to implement a Gaza truce.

Over in Moscow, Russia accused Ukraine of trying to "derail" agreements reached between Vladimir Putin and Donald Trump to halt strikes on energy infrastructure.

The yen gave up initial gains against the dollar after the Bank of Japan kept interest rates on hold, warning about "high uncertainties" including over trade.

Japan's Nikkei 225 stock index also gave up gains to end lower.

Elsewhere in Asia, Jakarta's stock market rebounded only slightly, having plummeted more than seven percent Tuesday in the biggest plunge since September 2011, over concerns about Indonesia's economy amid weak consumer spending.

In Europe, London and Frankfurt indices dipped while Paris gained in late morning deals.

Official data showed eurozone inflation eased more than previously estimated in February, driven by a slowdown in consumer price increases in Germany.

Inflation in the single currency area slowed to 2.3 percent last month, a slight change from the 2.4 percent figure published on March 3.

Elsewhere, the Turkish lira plunged to an all-time low against the dollar on Wednesday, after police raided the home of Istanbul's powerful opposition mayor, Ekrem Imamoglu.

The currency was trading at 39 liras per dollar after the mayor, a key opponent of President Recep Tayyip Erdogan, was detained over a corruption probe, a move denounced by his opposition CHP party as a "coup".

Looking to Wall Street's reopening, "the S&P 500 is set to open flat, amid high caution ahead of the crunch central bank decision", said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

"The Fed is widely expected to keep interest rates on hold, but investors will be hanging on (Fed chief) Jerome Powell’s words about future rate cuts.

"The tide has turned, with even the prospect of lowering borrowing costs unlikely to provide much solace given that they would be seen as indicating increasing weakness in the US economy," Streeter added.

Many economists have warned that the tariffs -- which are being met with retaliation by some countries -- will tip the US economy, and possibly others, into recession.

- Key figures around 1030 GMT -

London - FTSE 100: DOWN 0.1 percent at 8,696.72 points

Paris - CAC 40: UP 0.5 percent at 8,154.74

Frankfurt - DAX: DOWN 0.1 percent at 23,351.57

Tokyo - Nikkei 225: DOWN 0.3 percent at 37,751.88 (close)

Hong Kong - Hang Seng Index: UP 0.1 percent at 24,771.14 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,426.43 (close)

New York - Dow: DOWN 0.6 percent at 41,581.31 (close)

Euro/dollar: DOWN at $1.0898 from $1.0944 on Tuesday

Pound/dollar: DOWN at 1.2969 from 1.3003

Dollar/yen: UP at 149.73 yen from 149.36 yen

Euro/pound: DOWN at 84.02 pence from 84.16 pence

West Texas Intermediate: DOWN 0.4 percent at $66.50 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $70.33 per barrel

A.Leibowitz--CPN