-

Maltese businessman accused in journalist's murder granted bail

Maltese businessman accused in journalist's murder granted bail

-

Kazakhstan delays release of Azerbaijan plane black box data

-

France asks EU to delay rights, environment business rules

France asks EU to delay rights, environment business rules

-

Troubled Burberry shows sign of recovery despite sales drop

-

Italy's Monte dei Paschi bids 13.3 bn euros for Mediobanca

Italy's Monte dei Paschi bids 13.3 bn euros for Mediobanca

-

How the Taliban restrict women's lives in Afghanistan

-

Bank of Japan hikes interest rate to 17-year high, boosts yen

Bank of Japan hikes interest rate to 17-year high, boosts yen

-

Catalonia eyes reversal of business exodus after big bank returns

-

Tajikistan launches crackdown on 'witchcraft' and fortune-telling

Tajikistan launches crackdown on 'witchcraft' and fortune-telling

-

Bank of Japan hikes interest rate to 17-year high, signals more

-

Asian markets build on Trump rally, yen climbs after BoJ cut

Asian markets build on Trump rally, yen climbs after BoJ cut

-

Survivors strive to ensure young do not forget Auschwitz

-

Asian markets build on Trump rally, yen steady ahead of BoJ

Asian markets build on Trump rally, yen steady ahead of BoJ

-

OpenAI unveils 'Operator' agent that handles web tasks

-

Bamboo farm gets chopping for US zoo's hungry new pandas

Bamboo farm gets chopping for US zoo's hungry new pandas

-

Fear in US border city as Trump launches immigration overhaul

-

242 mn children's schooling disrupted by climate shocks in 2024: UNICEF

242 mn children's schooling disrupted by climate shocks in 2024: UNICEF

-

US Republicans pressure Democrats with 'born-alive' abortion bill

-

Trump Davos address lifts S&P 500 to record, dents oil prices

Trump Davos address lifts S&P 500 to record, dents oil prices

-

Between laughs and 'disaster', Trump divides Davos

-

Hundreds of people protest ahead of Swiss Davos meeting

Hundreds of people protest ahead of Swiss Davos meeting

-

US falling behind on wind power, think tank warns

-

US news giant CNN eyes 200 job cuts, streaming overhaul

US news giant CNN eyes 200 job cuts, streaming overhaul

-

Rubio chooses Central America for first trip amid Panama Canal pressure

-

Wall Street's AI-fuelled rally falters, oil slumps

Wall Street's AI-fuelled rally falters, oil slumps

-

Trump tells Davos elites: produce in US or pay tariffs

-

Progressive politics and nepo 'babies': five Oscar takeaways

Progressive politics and nepo 'babies': five Oscar takeaways

-

American Airlines shares fall on lackluster 2025 profit outlook

-

France to introduce new sex education guidelines in schools

France to introduce new sex education guidelines in schools

-

Wall Street's AI-fuelled rally falters

-

Drinking water in many French cities contaminated: study

Drinking water in many French cities contaminated: study

-

After Musk gesture, activists project 'Heil' on Tesla plant

-

ICC prosecutor seeks arrest of Taliban leaders over persecution of women

ICC prosecutor seeks arrest of Taliban leaders over persecution of women

-

Syria's economy reborn after being freed from Assad

-

Shoppers unaware as Roman tower lurks under French supermarket

Shoppers unaware as Roman tower lurks under French supermarket

-

Stocks mainly rise after Wall Street's AI-fuelled rally

-

Singer Chris Brown sues Warner Bros for $500 mn over documentary

Singer Chris Brown sues Warner Bros for $500 mn over documentary

-

J-pop star Nakai to retire after sexual misconduct allegations

-

Leaky, crowded and hot: Louvre boss slams her own museum

Leaky, crowded and hot: Louvre boss slams her own museum

-

WWF blasts Sweden, Finland over logging practices

-

How things stand in China-US trade tensions with Trump 2.0

How things stand in China-US trade tensions with Trump 2.0

-

Most Asian markets rise after Wall Street's AI-fuelled rally

-

Fire-hit Hollywood awaits Oscar nominees, with 'Emilia Perez' in front

Fire-hit Hollywood awaits Oscar nominees, with 'Emilia Perez' in front

-

New rider in town: Somalia's first woman equestrian turns heads

-

Most Asian markets extend AI-fuelled rally

Most Asian markets extend AI-fuelled rally

-

Bangladesh student revolutionaries' dreams dented by joblessness

-

Larry Ellison, tech's original maverick, makes Trump era return

Larry Ellison, tech's original maverick, makes Trump era return

-

Political crisis hits South Korea growth: central bank

-

Photonis Launches Two Market-Leading Solutions to Advance Single Photon Detection and Imaging Applications

Photonis Launches Two Market-Leading Solutions to Advance Single Photon Detection and Imaging Applications

-

Les Paul owned by guitar god Jeff Beck auctioned for over £1 mn

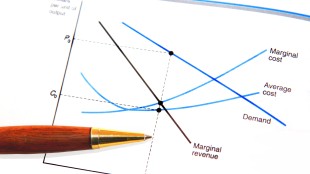

Stocks extend losses after Fed chief's rates warning

Stocks slid further Monday and the dollar rallied as traders continued to digest Federal Reserve chief Jerome Powell's warning of more interest rate hikes to fight inflation.

Wall Street's main indices opened lower, extending losses of between three and four percent on Friday immediately following Powell's speech where he clearly stated his priority is bringing inflation down from four-decade highs, even at the expense of economic growth.

"Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance," he told the Jackson Hole gathering of global monetary policymakers.

The comments dealt a blow to markets, which had in recent weeks enjoyed a bounce from June lows as weak economic data and a slowdown in price rises fanned hopes the Fed would temper its interest rate hike drive and bring down rates next year.

Powell "didn't splash some cold water on the stock market's face," said market analyst Patrick O'Hare at Briefing.com. "He dumped a whole bucket of ice water on it and the stock market wasn't ready for the ice bucket challenge."

Yanxi Tan of Malayan Banking said: "The game of assessing the Fed outlook has shifted from guessing how high the peak rate might be to also understanding how long it might stay there for."

Analysts said the chances of a third successive 75 basis-point increase next month had risen, with US Treasury yields -- a gauge of future interest rates -- surging. That in turn helped propel the dollar higher.

The dollar closed in on the 140 yen mark not seen since 1998, but an easing in European gas prices helped the euro recup its losses.

"Powell sent the dollar rallying ... on the back of a solid divergence between the decidedly hawkish Fed, and more hawkish, but increasingly worried other central banks," said Swissquote Bank analyst Ipek Ozkardeskaya.

"Other major central banks are also hawkish, but they are less aggressive than the Fed," she added.

Asian stocks ended sharply lower save for Shanghai, which eked out a small gain.

In afternoon European trading Paris and Frankfurt were also nursing losses. London was closed for a holiday.

European gas prices retreated from record highs set last week after Germany said Sunday that it is replenishing its gas stocks more quickly than expected and should meet an October target early despite drastic Russian supply cuts.

An emergency meeting of EU energy ministers was called for next week, with European Commission chief Ursula von der Leyen saying the bloc is working on an "emergency intervention" to rein in electricity prices sent soaring by Russia's war in Ukraine as well as a structural reform of the market.

Oil prices extended gains despite talk that surging interest rates could choke off the economic recovery as traders focused on supply concerns.

The commodity has fallen in recent weeks on bets that demand will be hit by an expected drop in economic output, particularly from China as it continues to battle a Covid-19 outbreak with lockdowns.

But fresh unrest in Libya, warnings that an Iran nuclear deal was not imminent and a possible OPEC output cut kept prices elevated.

- Key figures at around 1330 GMT -

New York - Dow: DOWN 0.8 percent at 32,039.07 points

EURO STOXX 50: DOWN 1.1 percent at 3,562.85

Frankfurt - DAX: DOWN 0.9 percent at 12,858.66

Paris - CAC 40: DOWN 1.2 percent at 6,199.37

London - FTSE 100: Closed for a holiday

Tokyo - Nikkei 225: DOWN 2.7 percent at 27,878.96 (close)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 20,023.22 (close)

Shanghai - Composite: UP 0.1 percent at 3,240.73 (close)

Euro/dollar: UP at $1.0002 from $0.9964 Friday

Pound/dollar: DOWN at $1.1713 from $1.1743

Euro/pound: UP at 85.40 pence from 84.85 pence

Dollar/yen: UP at 138.46 yen from 137.38 yen

West Texas Intermediate: UP 1.7 percent at $94.65 per barrel

Brent North Sea crude: UP 1.5 percent at $102.51

burs-rl/lth

T.Morelli--CPN