-

Trump asks US Supreme Court to pause law threatening TikTok ban

Trump asks US Supreme Court to pause law threatening TikTok ban

-

Tech slump slays Santa rally, weak yen lifts Japan stocks higher

-

Montenegro to extradite crypto entrepreneur Do Kwon to US

Montenegro to extradite crypto entrepreneur Do Kwon to US

-

Brazil views labor violations at BYD site as human 'trafficking'

-

Weak yen lifts Japan stocks higher, Wall Street slides

Weak yen lifts Japan stocks higher, Wall Street slides

-

Tourists return to post-Olympic Paris for holiday magic

-

Global stocks rise as Japan led Asia gains on a weaker yen

Global stocks rise as Japan led Asia gains on a weaker yen

-

Asian markets mostly rise but political turmoil holds Seoul back

-

Move over Mercedes: Chinese cars grab Mexican market share

Move over Mercedes: Chinese cars grab Mexican market share

-

Japanese shares gain on weaker yen after Christmas break

-

Fleeing Myanmar, Rohingya refugees recall horror of war

Fleeing Myanmar, Rohingya refugees recall horror of war

-

Peru ex-official denies running Congress prostitution ring

-

The Bilingual Book Company Launches New, Innovative Bilingual Audiobook App

The Bilingual Book Company Launches New, Innovative Bilingual Audiobook App

-

US stocks take a breather, Asian bourses rise in post-Christmas trade

-

Three dead, four injured in Norway bus accident

Three dead, four injured in Norway bus accident

-

Turkey lowers interest rate to 47.5 percent

-

Sri Lanka train memorial honours tsunami tragedy

Sri Lanka train memorial honours tsunami tragedy

-

Asia stocks up as 'Santa Rally' persists

-

2004 Indian Ocean tsunami: what to know 20 years on

2004 Indian Ocean tsunami: what to know 20 years on

-

Russian state owner says cargo ship blast was 'terrorist attack'

-

Sweeping Vietnam internet law comes into force

Sweeping Vietnam internet law comes into force

-

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

Demand for Japanese content booms post 'Shogun'

-

Mystery drones won't interfere with Santa's work: US tracker

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

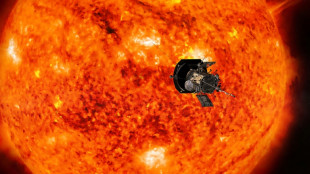

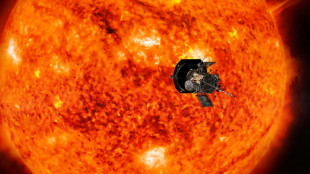

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

| RBGPF | -1.17% | 59.8 | $ | |

| BCC | -1.91% | 120.63 | $ | |

| SCS | 0.58% | 11.97 | $ | |

| RIO | -0.41% | 59.01 | $ | |

| RYCEF | 0.14% | 7.26 | $ | |

| GSK | -0.12% | 34.08 | $ | |

| CMSD | -0.67% | 23.32 | $ | |

| RELX | -0.61% | 45.58 | $ | |

| NGG | 0.66% | 59.31 | $ | |

| JRI | -0.41% | 12.15 | $ | |

| BCE | -0.93% | 22.66 | $ | |

| VOD | 0.12% | 8.43 | $ | |

| CMSC | -0.85% | 23.46 | $ | |

| AZN | -0.39% | 66.26 | $ | |

| BP | 0.38% | 28.96 | $ | |

| BTI | -0.33% | 36.31 | $ |

European equities stage rebound before US data

Europe's stock markets rose Friday before key US jobs data, after diving the previous day on fears of an inflation-induced recession.

Frankfurt won 1.5 percent, London gained 0.7 percent and Paris added 0.6 percent after a subdued Asian session.

All three markets tanked Thursday as record-high eurozone inflation fuelled fears that the European Central Bank will ramp up interest rates again next week, even as the region faces rocketing winter energy prices over Russia's war on Ukraine.

Elsewhere on Friday, oil prices rallied Friday on fading expectations for an Iran nuclear deal anytime soon, but remain under pressure from issues including the strong dollar, China's renewed Covid lockdowns, and worries about a demand-sapping recession.

- Data 'commands attention' -

All eyes are now on a key US non-farm payrolls (NFP) report slated for publication later Friday, for clues on the Federal Reserve's interest rate outlook.

"This economic reading commands the most attention," noted AvaTrade analyst Naeem Aslam.

"As always, the Fed will watch this data very closely and it is highly likely to influence their monetary policy decision."

With US rates expected to keep rising, the dollar has rallied to highs not seen for decades including against the pound and euro.

Bets are now increasing on a third successive 75-basis-point increase at the Fed's September meeting.

The dollar eased Friday but held above 140 yen -- one day after breaching the key level for the first time since 1998.

"Profit-taking was the name of the game as euro/dollar climbed back above parity, although dollar/yen continued to press ahead," noted City Index analyst Fawad Razaqzada.

Recent healthy readings on US factory activity, unemployment claims and private jobs creation indicated the world's top economy remained strong despite rising interest rates and four-decade-high inflation.

Wall Street ended Thursday with a late rally, with the Dow and S&P 500 snapping a four-day retreat, though the Nasdaq extended its losing streak.

- Key figures at around 1100 GMT -

London - FTSE 100: UP 0.7 percent at 7,200.60 points

Frankfurt - DAX: UP 1.5 percent at 12,820.41

Paris - CAC 40: UP 0.6 percent at 6,071.24

EURO STOXX 50: UP 0.8 percent at 3,484.42

Tokyo - Nikkei 225: FLAT at 27,650.84 (close)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 19,452.09 (close)

Shanghai - Composite: UP 0.1 percent at 3,186.48 (close)

New York - Dow: UP 0.5 percent at 31,656.42 (close)

Dollar/yen: UP at 140.32 yen from 139.44 yen on Thursday

Euro/dollar: UP at $1.0008 from $0.9946

Pound/dollar: UP at $1.1564 from $1.1545

Euro/pound: UP at 86.51 pence from 86.14 pence

West Texas Intermediate: UP 2.3 percent at $88.62 per barrel

Brent North Sea crude: UP 2.1 percent at $94.27

burs-rfj/rl

X.Cheung--CPN