-

Asian markets mostly rise but political turmoil holds Seoul back

Asian markets mostly rise but political turmoil holds Seoul back

-

Move over Mercedes: Chinese cars grab Mexican market share

-

Japanese shares gain on weaker yen after Christmas break

Japanese shares gain on weaker yen after Christmas break

-

Fleeing Myanmar, Rohingya refugees recall horror of war

-

Peru ex-official denies running Congress prostitution ring

Peru ex-official denies running Congress prostitution ring

-

US stocks take a breather, Asian bourses rise in post-Christmas trade

-

Three dead, four injured in Norway bus accident

Three dead, four injured in Norway bus accident

-

Turkey lowers interest rate to 47.5 percent

-

Sri Lanka train memorial honours tsunami tragedy

Sri Lanka train memorial honours tsunami tragedy

-

Asia stocks up as 'Santa Rally' persists

-

2004 Indian Ocean tsunami: what to know 20 years on

2004 Indian Ocean tsunami: what to know 20 years on

-

Russian state owner says cargo ship blast was 'terrorist attack'

-

Sweeping Vietnam internet law comes into force

Sweeping Vietnam internet law comes into force

-

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

Demand for Japanese content booms post 'Shogun'

-

Mystery drones won't interfere with Santa's work: US tracker

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

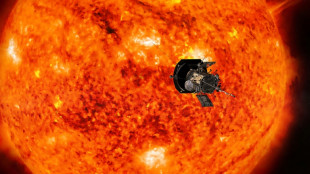

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Trump vows to 'stop transgender lunacy' as a top priority

Trump vows to 'stop transgender lunacy' as a top priority

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Sweet smell of success for niche perfumes

Sweet smell of success for niche perfumes

-

'Finally, we made it!': Ho Chi Minh City celebrates first metro

-

Tunisia women herb harvesters struggle with drought and heat

Tunisia women herb harvesters struggle with drought and heat

-

Trump threatens to take back control of Panama Canal

-

Secretive game developer codes hit 'Balatro' in Canadian prairie province

Secretive game developer codes hit 'Balatro' in Canadian prairie province

-

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

Money transfer firms replace banks in crisis-hit Lebanon

Like many people in crisis-hit Lebanon, Elias Skaff used to wait for hours to withdraw cash at the bank but now prefers money transfer companies as trust in lenders has evaporated.

Anyone who relies on traditional banks to receive their money "will die 100 times before cashing it", said Skaff, 50, who has survived Lebanon's three-year-old economic downturn with the help of US dollar payments from a relative abroad.

Once the flagship of Lebanon's economy, the banking sector is now widely despised and avoided after banks barred depositors from accessing their savings, stopped offering loans and closed hundreds of branches and slashed thousands of jobs.

Last month, a local man was widely cheered as a folk hero after he stormed a Beirut bank with a rifle and held employees and customers hostage for hours to demand some of his $200,000 in frozen savings to pay hospital bills for his sick father.

Increasingly, as Lebanon's deep crisis shows no sign of abating, money transfer agencies are filling the gap, also offering currency exchange, credit card and tax payment services and even setting up wedding gift registries.

Skaff said he now receives his money via a Beirut branch of Western Union's Lebanese agent OMT, which says it operates more than 1,200 branches nationwide and handles 80 percent of money transfers outside the Lebanese banking sector.

"We create services similar to those that banks provide at the request of our customers," said OMT spokesman Naji Abou Zeid.

Lebanon has been battered by its worst-ever economic crisis since the financial sector went into meltdown in 2019. The local currency has lost more than 90 percent of its value on the black market, as poverty and unemployment have soared.

Angry protesters have often targeted banks, trashing their ATM machines with rocks and spray cans.

"We can't even withdraw a penny" from the bank, said 45-year-old Alaa Sheikhani, a customer standing in line at an OMT branch.

"How are we supposed to trust them with our money?"

- Surviving on remittances -

Elie, 36, who recently got married, said he used Whish Money, a Lebanese money transfer firm, to set up his wedding gift registry, something he said saved wedding guests time, hassle and money in fees.

"Rather than waiting for hours at the bank, which is often crowded, they can hand over the money to an agency," said the man who asked not to be fully named. "In terms of time saved and costs, it's incomparable."

Whish Money's marketing director Dina Daher said the company is winning customers by charging "zero fees" on Lebanese pound transfers.

Some companies are now even paying salaries through money transfer companies instead of banks.

"When the crisis began, we were forced to pay salaries in cash, and it was a waste of time," because accountants had to count out large bundles of banknotes, said Rachelle Bou Nader, a human resources manager.

But now her firm, sporting goods retailer Mike Sport, pays its employees through Whish, allowing them to "withdraw their salary easily, in instalments, and free of charge", said Bou Nader.

Sami Nader, director of the Levant Institute for Strategic Affairs, said remittances from the Lebanese diaspora have become crucial to help families weather the crushing economic crisis.

"Today, a young Lebanese employee living abroad won't hesitate to send $100 to his parents because this sum now makes a difference," he said.

Lebanese banks have drastically increased fees on the few services they still offer -- including foreign currency transfers, now their only meaningful source of income -- said Nader, who added that this has further fuelled the exodus to money transfer companies.

About 250,000 residents of Lebanon received remittances in the first half of 2022, according to OMT, up eight percent from the same period last year.

The World Bank has reported that Lebanon received $6.6 billion in remittances in 2021, one of the highest levels in the Middle East and North Africa.

X.Wong--CPN