-

Turkey lowers interest rate to 47.5 percent

Turkey lowers interest rate to 47.5 percent

-

Sri Lanka train memorial honours tsunami tragedy

-

Asia stocks up as 'Santa Rally' persists

Asia stocks up as 'Santa Rally' persists

-

2004 Indian Ocean tsunami: what to know 20 years on

-

Russian state owner says cargo ship blast was 'terrorist attack'

Russian state owner says cargo ship blast was 'terrorist attack'

-

Sweeping Vietnam internet law comes into force

-

Thousands attend Christmas charity dinner in Buenos Aires

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

-

Mystery drones won't interfere with Santa's work: US tracker

Mystery drones won't interfere with Santa's work: US tracker

-

Global stocks mostly higher in thin pre-Christmas trade

-

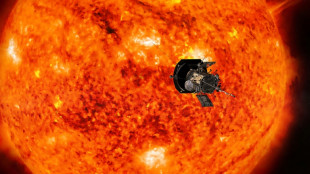

NASA probe makes closest ever pass by the Sun

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

Asian markets track Wall St rally as US inflation eases rate worries

-

Trump vows to 'stop transgender lunacy' as a top priority

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Sweet smell of success for niche perfumes

-

'Finally, we made it!': Ho Chi Minh City celebrates first metro

'Finally, we made it!': Ho Chi Minh City celebrates first metro

-

Tunisia women herb harvesters struggle with drought and heat

-

Trump threatens to take back control of Panama Canal

Trump threatens to take back control of Panama Canal

-

Secretive game developer codes hit 'Balatro' in Canadian prairie province

-

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

-

Banned Russian skater Valieva stars at Moscow ice gala

-

Biden signs funding bill to avert government shutdown

Biden signs funding bill to avert government shutdown

-

Sorrow and fury in German town after Christmas market attack

-

France's most powerful nuclear reactor finally comes on stream

France's most powerful nuclear reactor finally comes on stream

-

Sierra Leone student tackles toxic air pollution

-

Amazon says US strike caused 'no disruptions'

Amazon says US strike caused 'no disruptions'

-

Qualcomm scores key win in licensing dispute with Arm

| RBGPF | -1.17% | 59.8 | $ | |

| RYCEF | 0% | 7.25 | $ | |

| SCS | 1.35% | 11.89 | $ | |

| CMSC | -0.49% | 23.655 | $ | |

| RIO | -0.09% | 59.145 | $ | |

| NGG | 0.07% | 58.9 | $ | |

| BP | 0.19% | 28.845 | $ | |

| BTI | 0.41% | 36.41 | $ | |

| GSK | 0.09% | 34.06 | $ | |

| AZN | 0.3% | 66.502 | $ | |

| RELX | -0.02% | 45.88 | $ | |

| VOD | 0.18% | 8.445 | $ | |

| BCC | -0.27% | 122.855 | $ | |

| BCE | -0.07% | 22.885 | $ | |

| CMSD | -0.77% | 23.47 | $ | |

| JRI | 0.25% | 12.18 | $ |

'Social' investment strategies under fire in Republican-led US states

Republican-led US states such as Texas and West Virginia are piling pressure on firms including giant asset manager BlackRock for supposedly boycotting oil and gas companies as part of "responsible" investment strategies.

But the companies say the fossil fuel boycott claims are false and rules barring states from dealing with major financial firms could potentially backfire on taxpayers.

Basing investments partly on a company's environmental, social and governance (ESG) practices is a sign of an unacceptable "ideological agenda," says Florida Governor Ron DeSantis, who is seen as a potential 2024 Republican presidential nominee.

Late last month, he ordered bankers managing the state's huge pension fund to ignore those criteria and instead prioritize "the financial security of the people of Florida over whimsical notions of a utopian tomorrow."

The state controller of Texas has, meanwhile, published a list of companies -- including BlackRock and several European banks -- deemed to be "boycotting" petroleum firms. State officials were instructed to no longer sign contracts with firms on the list.

West Virginia, a smaller state but one rich in coal and natural gas, similarly singled out not just BlackRock, but also such Wall Street pillars as JPMorgan Chase, Wells Fargo, Goldman Sachs and Morgan Stanley.

"Any institution with policies aimed at weakening our energy industries, tax base and job market has a clear conflict of interest in handling taxpayer dollars," that state's treasurer, Riley Moore, said in a statement.

- 'Disconnected from reality' -

The banks targeted, however, deny they are engaging in any such boycott.

While some of them have decided to stop financing oil exploration projects in the Arctic, for example, they are continuing to lend money to the industry.

JP Morgan decried West Virginia's rule as "shortsighted and disconnected from the facts."

BlackRock, the world's biggest asset manager, says it has invested more than $108 billion in Texas oil companies, including ExxonMobil.

Referring to Texas's new rule, the Wall Street firm said in a statement that "elected and appointed public officials have a duty to act in the best interests of the people they serve. Politicizing state pension funds, restricting access to investments, and impacting the financial returns of retirees, is not consistent with that duty."

Joshua Lichtenstein, whose law firm Ropes & Gray tracks the way states are regulating ESG investments, said that the Republican-led attacks may be misguided.

"The political rhetoric is addressing a world that doesn't exist," he said.

The choice is not really between directing "investment capital towards ESG or investment capital towards returns," Lichtenstein told AFP. "It's really more about investing towards funds that are using ESG as part of a risk-mitigation strategy."

And investors are pushed in that direction by a growing number of clients, not only in Democratic-led US states but in Europe and Japan.

The northeastern state of Maine in 2021 adopted a law requiring the state's pension system to divest itself of shares in fossil fuel companies.

- A cost to taxpayers -

The new rules in Republican states could come at a cost to those states' taxpayers, said Ben Cushing, a financial specialist with the environmental advocacy group the Sierra Club.

Texas, for example, last year adopted a law banning its cities from signing new contracts with banks that limit investment in petroleum companies or gun manufacturers.

The result: the number of establishments participating in municipal bond issues in Texas has declined and negotiated rates have risen -- costing taxpayers millions in extra interest -- according to a June study by researchers at the University of Pennsylvania and the US Federal Reserve.

Lichtenstein said it is too early to know the broader impact of the Republican campaign.

He said it would not necessarily threaten an already well-established trend: clients are increasingly sensitive to climate change, for example, and investment managers still must take all risks into account.

But "the red states are probably the loudest," Lichtenstein added, and if Republican states such as Florida actively enforce their new rules, fund managers may seek to avoid conflict.

Ultimately, said the Sierra Club's Cushing, that could compel financial establishments to slow their ESG efforts just as they "belatedly are beginning to address the climate crisis and recognize the very real financial implications of climate change."

A.Leibowitz--CPN