-

Three dead, four injured in Norway bus accident

Three dead, four injured in Norway bus accident

-

Turkey lowers interest rate to 47.5 percent

-

Sri Lanka train memorial honours tsunami tragedy

Sri Lanka train memorial honours tsunami tragedy

-

Asia stocks up as 'Santa Rally' persists

-

2004 Indian Ocean tsunami: what to know 20 years on

2004 Indian Ocean tsunami: what to know 20 years on

-

Russian state owner says cargo ship blast was 'terrorist attack'

-

Sweeping Vietnam internet law comes into force

Sweeping Vietnam internet law comes into force

-

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

Demand for Japanese content booms post 'Shogun'

-

Mystery drones won't interfere with Santa's work: US tracker

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

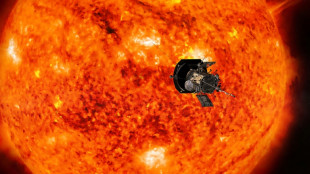

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Trump vows to 'stop transgender lunacy' as a top priority

Trump vows to 'stop transgender lunacy' as a top priority

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Sweet smell of success for niche perfumes

Sweet smell of success for niche perfumes

-

'Finally, we made it!': Ho Chi Minh City celebrates first metro

-

Tunisia women herb harvesters struggle with drought and heat

Tunisia women herb harvesters struggle with drought and heat

-

Trump threatens to take back control of Panama Canal

-

Secretive game developer codes hit 'Balatro' in Canadian prairie province

Secretive game developer codes hit 'Balatro' in Canadian prairie province

-

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

-

Banned Russian skater Valieva stars at Moscow ice gala

Banned Russian skater Valieva stars at Moscow ice gala

-

Biden signs funding bill to avert government shutdown

-

Sorrow and fury in German town after Christmas market attack

Sorrow and fury in German town after Christmas market attack

-

France's most powerful nuclear reactor finally comes on stream

-

Sierra Leone student tackles toxic air pollution

Sierra Leone student tackles toxic air pollution

-

Amazon says US strike caused 'no disruptions'

| RIO | -0.11% | 59.135 | $ | |

| CMSC | -0.49% | 23.655 | $ | |

| RBGPF | -1.17% | 59.8 | $ | |

| BTI | 0.55% | 36.46 | $ | |

| SCS | 1.1% | 11.86 | $ | |

| RYCEF | 0% | 7.25 | $ | |

| NGG | -0.05% | 58.83 | $ | |

| RELX | -0.02% | 45.88 | $ | |

| BP | 0.11% | 28.823 | $ | |

| BCE | -0.33% | 22.825 | $ | |

| VOD | -0.06% | 8.425 | $ | |

| CMSD | -0.81% | 23.46 | $ | |

| BCC | -0.21% | 122.936 | $ | |

| AZN | 0.33% | 66.52 | $ | |

| JRI | 0.16% | 12.17 | $ | |

| GSK | 0.04% | 34.045 | $ |

ECB poised for big rate hike in face of record inflation

After raising interest rates for the first time in over a decade at their last meeting, European Central Bank policymakers are poised to deliver another bumper hike on Thursday in a show of determination to tame soaring inflation.

Steep increases in the price of energy in the wake of the Russian invasion of Ukraine have heaped pressure on households and sent the pace of consumer price rises to new highs.

Eurozone inflation hit 9.1 percent in August, a record in the history of the single currency and well above the two-percent rate targeted by the ECB.

The "only question" for the ECB's meeting was "whether it will be a 50 or 75 basis point hike," said Carsten Brzeski, head of macro at the ING bank.

Speaking at the annual Jackson Hole central banking symposium at the end of August, ECB board member Isabel Schnabel said the ECB needed to show "determination" to tame price rises.

Under this approach, the central bank would respond "more forcefully to the current bout of inflation, even at the risk of lower growth and higher unemployment", she said.

- 'Only question' -

The ECB's 25-member governing council surprised with a 50-basis-point hike at its last meeting in July, bringing an end to eight years of negative interest rates in one fell swoop.

In her speech in the United States, Schnabel stressed the need for the people to "trust" that the ECB will restore their purchasing power.

The Frankfurt-based institution is already playing catch up with other central banks in the US and Britain that started raising rates harder and faster in response to inflation.

So-called forward guidance issued by the ECB, which limited its scope for action, has been ditched. Policymakers would now take their decisions "meeting-by-meeting", the ECB President Christine Lagarde announced in July.

With that, the door has been opened for the ECB to follow in the footsteps of the US Federal Reserve and raise rates by a 75 basis points.

Following August's red-hot inflation numbers, the influential head of the German central bank, Joachim Nagel, said the ECB needed a "strong rise in interest rates in September".

- 'Steady pace' -

"Further interest rate steps are to be expected in the following months," the Bundesbank president predicted.

But the ECB's chief economist, Philip Lane, has counselled colleagues to follow a "steady pace" of interest rate rises.

Hiking at a rate that was "neither too slow nor too fast" was important due to the "high uncertainty" around the economy and the future path of inflation.

Alongside its policy decisions, the ECB will also share an updated set of economic forecasts for the eurozone.

In its last estimates, published in June, the ECB said it expected inflation to sit at 6.8 percent in 2022 before falling to 3.5 percent next year, while growth would slow from 2.8 percent this year to 2.1 in 2023.

But a more severe energy shock as Russia reduces gas deliveries to Europe could push the eurozone into a "deeper winter recession" and hold growth to zero percent in 2023, said Frederik Ducrozet, head of macroeconomic research at Pictet.

At the same time, the soaring cost of energy would drive inflation close to double digits by the end of the year, he predicted.

The ECB had "no choice but to commit to faster monetary tightening as long as inflation keeps rising" even as a recession loomed, said Ducrozet.

Y.Tengku--CPN