-

Turkey lowers interest rate to 47.5 percent

Turkey lowers interest rate to 47.5 percent

-

Sri Lanka train memorial honours tsunami tragedy

-

Asia stocks up as 'Santa Rally' persists

Asia stocks up as 'Santa Rally' persists

-

2004 Indian Ocean tsunami: what to know 20 years on

-

Russian state owner says cargo ship blast was 'terrorist attack'

Russian state owner says cargo ship blast was 'terrorist attack'

-

Sweeping Vietnam internet law comes into force

-

Thousands attend Christmas charity dinner in Buenos Aires

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

-

Mystery drones won't interfere with Santa's work: US tracker

Mystery drones won't interfere with Santa's work: US tracker

-

Global stocks mostly higher in thin pre-Christmas trade

-

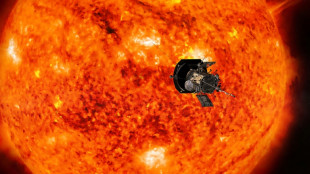

NASA probe makes closest ever pass by the Sun

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

Asian markets track Wall St rally as US inflation eases rate worries

-

Trump vows to 'stop transgender lunacy' as a top priority

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Sweet smell of success for niche perfumes

-

'Finally, we made it!': Ho Chi Minh City celebrates first metro

'Finally, we made it!': Ho Chi Minh City celebrates first metro

-

Tunisia women herb harvesters struggle with drought and heat

-

Trump threatens to take back control of Panama Canal

Trump threatens to take back control of Panama Canal

-

Secretive game developer codes hit 'Balatro' in Canadian prairie province

-

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

-

Banned Russian skater Valieva stars at Moscow ice gala

-

Biden signs funding bill to avert government shutdown

Biden signs funding bill to avert government shutdown

-

Sorrow and fury in German town after Christmas market attack

-

France's most powerful nuclear reactor finally comes on stream

France's most powerful nuclear reactor finally comes on stream

-

Sierra Leone student tackles toxic air pollution

-

Amazon says US strike caused 'no disruptions'

Amazon says US strike caused 'no disruptions'

-

Qualcomm scores key win in licensing dispute with Arm

| RBGPF | -1.17% | 59.8 | $ | |

| RYCEF | 0% | 7.25 | $ | |

| SCS | 1.35% | 11.89 | $ | |

| CMSC | -0.49% | 23.655 | $ | |

| RIO | -0.09% | 59.145 | $ | |

| NGG | 0.07% | 58.9 | $ | |

| BP | 0.19% | 28.845 | $ | |

| BTI | 0.41% | 36.41 | $ | |

| GSK | 0.09% | 34.06 | $ | |

| AZN | 0.3% | 66.502 | $ | |

| RELX | -0.02% | 45.88 | $ | |

| VOD | 0.18% | 8.445 | $ | |

| BCC | -0.27% | 122.855 | $ | |

| BCE | -0.07% | 22.885 | $ | |

| CMSD | -0.77% | 23.47 | $ | |

| JRI | 0.25% | 12.18 | $ |

European stocks, euro tumble as Russia fuels energy crisis

European stocks tumbled Monday and the euro hit a new 20-year dollar low on energy crisis fears, after Russia said it would not restart gas flows to Germany and effectively most of the continent.

Natural gas prices spiked almost a third, while oil rallied on expectations OPEC and its Russia-led allies could decide at a meeting Monday to lower crude output in a bid to lift prices.

Europe's fast-moving gas crisis sent Frankfurt equities slumping more than three percent before trimming losses, while Paris shed two percent at one stage.

London stocks also lost ground before the much-anticipated announcement of Britain's next prime minister at around 1130 GMT.

- 'Weaponization of energy' -

"Russia's ongoing weaponization of energy supplies continues to increase downside risks for European economies and the euro," said Lee Hardman, currency analyst at financial services group MUFG.

The euro sank Monday to $0.9878, its lowest since December 2002, despite expectations the European Central Bank will hike interest rates again Thursday to combat soaring inflation.

The shared eurozone unit has collapsed by about 13 percent against the dollar since the start of the year, hit also by the US Federal Reserve's more aggressive monetary tightening.

State gas giant Gazprom announced late Friday the key Nord Stream pipeline would remain shut indefinitely, blaming leaks.

Gazprom's announcement came the same day as the G7 nations said they would work to quickly implement a price cap on Russian oil exports, a move that would starve the Kremlin of critical revenue for its war on Ukraine.

Resumption of deliveries via the pipeline, which runs from near Saint Petersburg to Germany under the Baltic Sea, had been due to resume on Saturday after what Gazprom had described as three days of maintenance work.

- 'Grim shadow before winter' -

The news intensified an energy crisis caused by Europe's sanctions on Moscow for its invasion of Ukraine in February.

Investors are fearful of an energy supply crunch during the peak-demand northern hemisphere winter.

That could potentially lead to a painful recession.

"Russia's decision to turn off Europe's gas hangs over the continent like a grim shadow ahead of winter," said AJ Bell investment director Russ Mould.

At the same time, governments worldwide are grappling with the impact of rocketing domestic energy costs.

Germany on Sunday unveiled a new 65-billion-euro ($65-billion) package to help households cope with soaring prices, and eyed windfall profits from energy companies to help fund the move.

That took Berlin's total relief to almost 100 billion euros since the start of the Ukraine war.

Elsewhere on Monday, Asian bourses experienced mixed trade as last week's upbeat US jobs report partly offset fears over Europe's outlook -- and China's new Covid lockdowns.

- Key figures at around 1000 GMT -

London - FTSE 100: DOWN 0.6 percent at 7,234.88 points

Frankfurt - DAX: DOWN 2.3 percent at 12,747.73

Paris - CAC 40: DOWN 1.6 percent at 6,071.27

EURO STOXX 50: DOWN 1.9 percent at 3,478.13

Tokyo - Nikkei 225: DOWN 0.1 percent at 27,619.61 (close)

Hong Kong - Hang Seng Index: DOWN 1.2 percent at 19,225.70 (close)

Shanghai - Composite: UP 0.4 percent at 3,199.91 (close)

New York - Dow: DOWN 1.1 percent at 31,318.44 (close)

Euro/dollar: DOWN at $0.9927 from $0.9954 on Friday

Dollar/yen: UP at 140.43 yen from 140.20 yen

Pound/dollar: UP at $1.1515 from $1.1509

Euro/pound: DOWN at 86.20 pence from 86.48 pence

West Texas Intermediate: UP 2.7 percent at $89.17 per barrel

Brent North Sea crude: UP 2.7 percent at $95.52 per barrel

burs-rfj/bcp/cdw

M.Mendoza--CPN