-

Three dead, four injured in Norway bus accident

Three dead, four injured in Norway bus accident

-

Turkey lowers interest rate to 47.5 percent

-

Sri Lanka train memorial honours tsunami tragedy

Sri Lanka train memorial honours tsunami tragedy

-

Asia stocks up as 'Santa Rally' persists

-

2004 Indian Ocean tsunami: what to know 20 years on

2004 Indian Ocean tsunami: what to know 20 years on

-

Russian state owner says cargo ship blast was 'terrorist attack'

-

Sweeping Vietnam internet law comes into force

Sweeping Vietnam internet law comes into force

-

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

Demand for Japanese content booms post 'Shogun'

-

Mystery drones won't interfere with Santa's work: US tracker

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

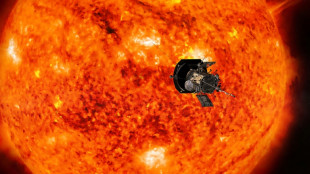

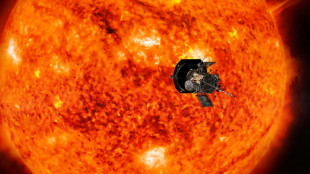

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Trump vows to 'stop transgender lunacy' as a top priority

Trump vows to 'stop transgender lunacy' as a top priority

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Sweet smell of success for niche perfumes

Sweet smell of success for niche perfumes

-

'Finally, we made it!': Ho Chi Minh City celebrates first metro

-

Tunisia women herb harvesters struggle with drought and heat

Tunisia women herb harvesters struggle with drought and heat

-

Trump threatens to take back control of Panama Canal

-

Secretive game developer codes hit 'Balatro' in Canadian prairie province

Secretive game developer codes hit 'Balatro' in Canadian prairie province

-

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

-

Banned Russian skater Valieva stars at Moscow ice gala

Banned Russian skater Valieva stars at Moscow ice gala

-

Biden signs funding bill to avert government shutdown

-

Sorrow and fury in German town after Christmas market attack

Sorrow and fury in German town after Christmas market attack

-

France's most powerful nuclear reactor finally comes on stream

-

Sierra Leone student tackles toxic air pollution

Sierra Leone student tackles toxic air pollution

-

Amazon says US strike caused 'no disruptions'

| RBGPF | -1.17% | 59.8 | $ | |

| CMSC | -0.49% | 23.655 | $ | |

| NGG | -0.02% | 58.85 | $ | |

| BCC | -0.37% | 122.74 | $ | |

| RIO | -0.15% | 59.113 | $ | |

| SCS | 1.14% | 11.865 | $ | |

| AZN | 0.35% | 66.535 | $ | |

| GSK | 0.01% | 34.034 | $ | |

| BTI | 0.38% | 36.4 | $ | |

| RELX | -0.02% | 45.88 | $ | |

| BP | 0.09% | 28.815 | $ | |

| RYCEF | 0% | 7.25 | $ | |

| JRI | 0.15% | 12.168 | $ | |

| VOD | 0.12% | 8.44 | $ | |

| CMSD | -0.77% | 23.47 | $ | |

| BCE | -0.42% | 22.805 | $ |

New UK PM Truss inherits economy headed for recession

New UK Prime Minister Liz Truss inherits an economy set to enter recession before the end of the year, with double-digit inflation forecast to soar further.

- Cost of living -

With inflation at a 40-year high above 10 percent, fuelled by rocketing energy and food prices, Truss promised during her campaign to cut taxes.

She pledged also to reverse a recent increase in workers' National Insurance contributions that fund the public health service and welfare payments.

Truss is also proposing to axe taxes on fuel that pay for the transition to cleaner energy but she has rejected "sticking plaster" solutions to the cost-of-living crisis such as direct government aid.

An emergency budget is expected within weeks, as the Bank of England (BoE) predicts that the UK will enter a year-long recession by the end of 2022.

Before then, Truss is expected to present a plan to tackle soaring energy bills.

"If I'm elected prime minister, I will act immediately on bills and on energy supply," Truss, who steps up from her role as foreign minister, told the BBC on Sunday.

British households are facing an eye-watering 80-percent average hike in electricity and gas bills from next month, in a dramatic worsening of the cost-of-living crisis before winter.

"Some of the promises Liz Truss has scattered on the campaign trail may flutter away once she takes office and the cold reality of the monumental crisis the government faces becomes clear," noted Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

- Energy -

Truss, 47, has backed the UK's ambition to achieve carbon neutrality by 2050.

She favours all-out investment in energy including controversial fracking technology where it is backed by locals.

Truss also wants more energy to come from the North Sea and backs current UK government policy on investment in nuclear power and renewables.

Boris Johnson last week pledged £700 million ($815 million) in funding for the new Sizewell C nuclear power station, as he prepared to hand over power as UK prime minister and Conservative party leader.

Sizewell C in eastern England is expected to be constructed in partnership with French energy firm EDF and could power the equivalent of about six million homes.

The UK is seeking to safeguard energy security after key producer Russia sent prices rocketing with its invasion of Ukraine.

- Brexit -

Truss backed remaining in the European Union before the 2016 referendum on membership of the bloc, switching sides after the public voted to leave.

Now unashamedly pro-Brexit, she has spearheaded proposed legislation to override parts of the Northern Ireland Protocol the UK signed with the EU governing current trade in the province.

She has promised to take all EU law off the UK statute book to help "turbocharge" growth.

Truss has made no proposals to address chronic post-Brexit labour shortages in the UK, particularly of seasonal workers.

- Financial regulation -

Truss has called for an overhaul of regulators in the City of London financial district.

Notably she wants to merge the Financial Conduct Authority, the Prudential Regulation Authority which oversees banks and is part of the Bank of England, and the Payment Systems Regulator.

Truss has been critical of the BoE's response to rising inflation and has proposed examining the statute that gave it operational independence over monetary policy in 1997.

Governor Andrew Bailey has noted in response that the UK's financial credibility was dependent on the bank's independence from government.

In a bid to cool soaring global inflation, the BoE and other major central banks have hiked interest rates several times this year.

H.Müller--CPN