-

Asia stocks up as 'Santa Rally' persists

Asia stocks up as 'Santa Rally' persists

-

2004 Indian Ocean tsunami: what to know 20 years on

-

Russian state owner says cargo ship blast was 'terrorist attack'

Russian state owner says cargo ship blast was 'terrorist attack'

-

Sweeping Vietnam internet law comes into force

-

Thousands attend Christmas charity dinner in Buenos Aires

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

-

Mystery drones won't interfere with Santa's work: US tracker

Mystery drones won't interfere with Santa's work: US tracker

-

Global stocks mostly higher in thin pre-Christmas trade

-

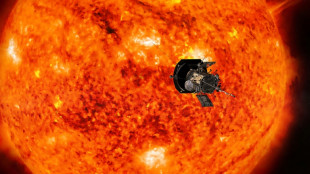

NASA probe makes closest ever pass by the Sun

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

Asian markets track Wall St rally as US inflation eases rate worries

-

Trump vows to 'stop transgender lunacy' as a top priority

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Sweet smell of success for niche perfumes

-

'Finally, we made it!': Ho Chi Minh City celebrates first metro

'Finally, we made it!': Ho Chi Minh City celebrates first metro

-

Tunisia women herb harvesters struggle with drought and heat

-

Trump threatens to take back control of Panama Canal

Trump threatens to take back control of Panama Canal

-

Secretive game developer codes hit 'Balatro' in Canadian prairie province

-

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

-

Banned Russian skater Valieva stars at Moscow ice gala

-

Biden signs funding bill to avert government shutdown

Biden signs funding bill to avert government shutdown

-

Sorrow and fury in German town after Christmas market attack

-

France's most powerful nuclear reactor finally comes on stream

France's most powerful nuclear reactor finally comes on stream

-

Sierra Leone student tackles toxic air pollution

-

Amazon says US strike caused 'no disruptions'

Amazon says US strike caused 'no disruptions'

-

Qualcomm scores key win in licensing dispute with Arm

-

Scientists observe 'negative time' in quantum experiments

Scientists observe 'negative time' in quantum experiments

-

US approves first drug treatment for sleep apnea

Asian markets mostly rise as bargain-buying offsets fears over outlook

Asian investors squeezed out gains Tuesday as they tried to recover from the previous day's losses, but they remain gripped by fears over Europe's worsening energy crisis, China's economic slowdown and central bank efforts to contain surging inflation.

The dollar lost some momentum, with the euro supported ahead of an expected European Central Bank interest rate hike and sterling lifted by reports that new UK Prime Minister Liz Truss will unveil plans to cut energy bills.

Russia's decision not to resume gas supplies to Europe -- in retaliation for sanctions over Ukraine -- sent shock waves through trading floors Monday as it ramped up expectations of a painful recession in major economies.

"This shouldn't have been a surprise to most people, given that it was widely expected that Putin would play this card at some point," said CMC Markets analyst Michael Hewson.

"Now that he has, Russia doesn't really have anywhere else to go, and while natural gas prices did shoot higher, they closed well off the highs of the day."

With Wall Street closed for a holiday, Asia had few new catalysts to drive buying.

Markets fluctuated between gains and losses in the morning but managed to clamber up as the day progressed.

Shanghai enjoyed a healthy bounce after China unveiled fresh economy-boosting measures.

But analysts warned that while a stimulus was welcomed as growth dwindles, traders were only looking for signs of an easing in the country's zero-Covid strategy, which has left millions in lockdown and threatens economic activity.

Hong Kong, Singapore, Seoul, Taipei, Manila, Mumbai, Bangkok and Jakarta all rose, while Tokyo was marginally up.

Sydney, however, dipped after the Reserve Bank of Australia lifted interest rates to a near eight-year high and warned of more pain ahead. Wellington also slipped.

London, Paris and Frankfurt eked out gains at the open.

- Global recession risk -

"A lot of clients are asking, have we seen the bottom yet and are we going into a global recession?" Grace Tam, of BNP Paribas Wealth Management Hong Kong, told Bloomberg Television.

"We do think the risk of a global recession, especially next year, is actually quite high" and that the energy crisis "is not fully priced" into markets, she said.

The next key event for investors is the ECB rate decision Thursday, with some observers tipping a 75 basis point hike to bring down record-high inflation.

That is followed later in the month by the Federal Reserve's meeting, where policymakers will debate a similar move, which would be the third rise in a row.

However, while central banks are lifting borrowing costs to fight surging prices, they have little power over the cost of oil, a key driver of the rises.

And on Monday, OPEC and other major producers announced a surprise cut in output, sending both main contracts rising. The move came after the crude market fell in recent months on demand fears caused by a possible recession.

"In absolute terms, the 100,000 barrels a day supply cut doesn't matter that much to global supply balances," said Noah Barrett of Janus Henderson Investors.

"However, in terms of signalling, the move is important as it indicates that OPEC+ is watching demand very closely and is trying to manage supply to keep a floor on oil prices."

Several countries including the United States had earlier called for a rise in production, which was followed by a small lift of 100,000 barrels.

"The modest increase we got a month ago is now gone, so OPEC+ is clearly sending a message that they are not bowing to external demands," said Barrett.

"We should expect continued volatility in oil prices, with global demand indicators driving price movements."

Brent and WTI were both down from Monday's levels.

- Key figures at around 0720 GMT -

Tokyo - Nikkei 225: FLAT at 27,626.51 (close)

Hong Kong - Hang Seng Index: UP 0.1 percent at 19,240.39

Shanghai - Composite: UP 1.4 percent at 3,243.45 (close)

London - FTSE 100: UP 0.1 percent at 7,293.46

Euro/dollar: UP at $0.9957 from $0.9921 on Monday

Pound/dollar: UP at $1.1575 from $1.1507

Dollar/yen: UP at 141.15 yen from 140.53 yen

Euro/pound: DOWN at 86.00 pence from 86.22 pence

West Texas Intermediate: DOWN 0.6 percent at $88.92 per barrel

Brent North Sea crude: DOWN 0.5 percent at $95.31 per barrel

New York - Dow: Closed for public holiday

A.Agostinelli--CPN