-

Asia stocks up as 'Santa Rally' persists

Asia stocks up as 'Santa Rally' persists

-

2004 Indian Ocean tsunami: what to know 20 years on

-

Russian state owner says cargo ship blast was 'terrorist attack'

Russian state owner says cargo ship blast was 'terrorist attack'

-

Sweeping Vietnam internet law comes into force

-

Thousands attend Christmas charity dinner in Buenos Aires

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

-

Mystery drones won't interfere with Santa's work: US tracker

Mystery drones won't interfere with Santa's work: US tracker

-

Global stocks mostly higher in thin pre-Christmas trade

-

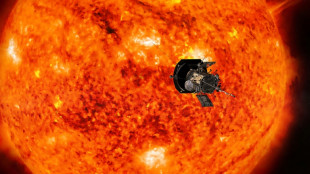

NASA probe makes closest ever pass by the Sun

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

Asian markets track Wall St rally as US inflation eases rate worries

-

Trump vows to 'stop transgender lunacy' as a top priority

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Sweet smell of success for niche perfumes

-

'Finally, we made it!': Ho Chi Minh City celebrates first metro

'Finally, we made it!': Ho Chi Minh City celebrates first metro

-

Tunisia women herb harvesters struggle with drought and heat

-

Trump threatens to take back control of Panama Canal

Trump threatens to take back control of Panama Canal

-

Secretive game developer codes hit 'Balatro' in Canadian prairie province

-

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

-

Banned Russian skater Valieva stars at Moscow ice gala

-

Biden signs funding bill to avert government shutdown

Biden signs funding bill to avert government shutdown

-

Sorrow and fury in German town after Christmas market attack

-

France's most powerful nuclear reactor finally comes on stream

France's most powerful nuclear reactor finally comes on stream

-

Sierra Leone student tackles toxic air pollution

-

Amazon says US strike caused 'no disruptions'

Amazon says US strike caused 'no disruptions'

-

Qualcomm scores key win in licensing dispute with Arm

-

Scientists observe 'negative time' in quantum experiments

Scientists observe 'negative time' in quantum experiments

-

US approves first drug treatment for sleep apnea

More European energy firms get state aid as prices soar

Finland and Switzerland offered financial backing to utility companies on Tuesday, the latest energy firms in Europe to receive state support as gas prices have spiked since Russia invaded Ukraine.

The conflict has created a cash crunch for power companies in Europe, prompting governments in several countries to open credit lines in recent months.

The Swiss Federal Energy office said Tuesday that Axpo, a publicly-owned Swiss electricity group, will have access to four billion Swiss francs ($4.1 billion) in credit to ensure liquidity after it requested the temporary aid last week.

"The government responded favourably to avoid putting Switzerland's energy supply in jeopardy," the office said in a statement, adding that Axpo was an electricity firm of "systemic importance" for the country.

In Finland, utility group Fortum said it had agreed on a bridge financing arrangement with the state -- which is also the majority owner -- to "ensure access to sufficient liquidity resources" if power prices continue to rise.

The liquidity facility gives Fortum access to 2.35 billion euros ($2.34 billion) through state-owned holding company Solidium, but Fortum said "utilisation of the arrangement is a last resort."

"The European energy crisis is a result of Russia's decision to use energy as a weapon," Fortum CEO Markus Rauramo said, adding that this has put his company and other Nordic energy suppliers "in a difficult situation."

"There is great uncertainty in the market and energy prices have been record high," Rauramo said.

Gas prices have soared since Russia invaded Ukraine.

Utilities rely on futures markets to guarantee a certain price for their supplies. Under the contracts, they are required to put collateral upfront.

But if prices rise, a company is required to put up more collateral, creating a potential cash crunch.

Fortum said the collateral tied up Nordic commodities exchange Nasdaq amounted to around 3.5 billion euros as of September 5.

"Regulatory changes are urgently needed to curb the unreasonably high margining and collateral requirements," Rauramo said.

- Europe-wide problem -

Other governments in Europe have offered billions of euros in loans to energy firms.

German energy giant Uniper said last week it would need an additional four billion euros in state-backed loans after already having used a nine-billion-euro credit line, following a July deal.

Fortum, which is the majority owner of Uniper, clarified in its statement that its arrangement with the Finnish state could not be used to cover Uniper's needs.

Also last week, Austria announced a two-billion-euro loan for Wien Energie, the country's main electricity provider.

At the weekend, Sweden said it would provide liquidity guarantees to Nordic and Baltic energy companies worth up to $23 billion in a bid to prevent a financial crisis sparked by Europe's energy crunch.

Independently of the agreement with Fortum, the Finnish government also proposed Sunday a rescue package of up to 10 billion euros in loans and guarantees for energy companies facing insolvency.

burs-jll/po/lth

Y.Ibrahim--CPN