-

Sweeping Vietnam internet law comes into force

Sweeping Vietnam internet law comes into force

-

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

Demand for Japanese content booms post 'Shogun'

-

Mystery drones won't interfere with Santa's work: US tracker

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

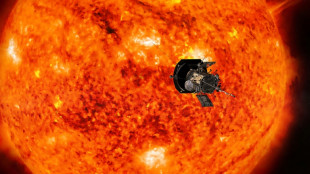

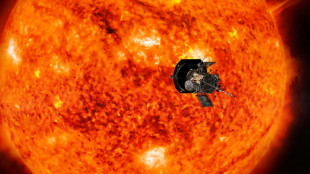

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Trump vows to 'stop transgender lunacy' as a top priority

Trump vows to 'stop transgender lunacy' as a top priority

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Sweet smell of success for niche perfumes

Sweet smell of success for niche perfumes

-

'Finally, we made it!': Ho Chi Minh City celebrates first metro

-

Tunisia women herb harvesters struggle with drought and heat

Tunisia women herb harvesters struggle with drought and heat

-

Trump threatens to take back control of Panama Canal

-

Secretive game developer codes hit 'Balatro' in Canadian prairie province

Secretive game developer codes hit 'Balatro' in Canadian prairie province

-

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

-

Banned Russian skater Valieva stars at Moscow ice gala

Banned Russian skater Valieva stars at Moscow ice gala

-

Biden signs funding bill to avert government shutdown

-

Sorrow and fury in German town after Christmas market attack

Sorrow and fury in German town after Christmas market attack

-

France's most powerful nuclear reactor finally comes on stream

-

Sierra Leone student tackles toxic air pollution

Sierra Leone student tackles toxic air pollution

-

Amazon says US strike caused 'no disruptions'

-

Qualcomm scores key win in licensing dispute with Arm

Qualcomm scores key win in licensing dispute with Arm

-

Scientists observe 'negative time' in quantum experiments

-

US approves first drug treatment for sleep apnea

US approves first drug treatment for sleep apnea

-

Amazon expects no disruptions as US strike goes into 2nd day

-

US confirms billions in chips funds to Samsung, Texas Instruments

US confirms billions in chips funds to Samsung, Texas Instruments

-

Wall Street rebounds despite US inflation ticking higher

Japan says ready for 'necessary response' as yen dives

Japan is ready to take action if the yen's plummeting value remains volatile, officials repeated on Thursday, after the currency hit 24-year lows.

The yen has tumbled from around 115 per dollar in March to lower than 140 last week, as the Bank of Japan (BoJ) sticks with its monetary easing policies in contrast to rate hikes from other central banks including the US Federal Reserve.

It has continued to drop fast, nearly touching 145 per dollar overnight in New York, as investors flooded into the US currency hoping for better returns and as a safe-haven hedge.

Japan has not announced any specific measures to bolster the yen, such as instructing the central bank to buy it against other currencies.

But on Thursday, officials from the BoJ, the finance ministry and the government's fiscal services agency held a meeting while the yen hovered close to 144 per dollar.

"If (the yen) continues to fluctuate like this, the government is ready to take the necessary response in financial markets," Masato Kanda, Vice-Minister of Finance for International Affairs, told reporters after the meeting.

"Various measures" are on the table, he said without giving details. His comments closely echoed remarks made Wednesday by Japan's finance minister, who said rapid shifts in foreign exchange rates were "not desirable".

Ray Attrill, head of FX strategy at National Australia Bank, said the rhetoric would have little effect.

"The market's not buying what the Japanese officials are selling in terms of their public concerns about the moves in the yen. They've basically been singing from exactly the same hymn sheet," he told AFP.

A weaker yen can help Japanese companies to sell products overseas, but "at these levels, the disadvantages of a weak yen are starting to outweigh the benefits," with households and businesses facing higher import prices, Attrill said.

Inflation more broadly has risen to seven-year highs in Japan, partly due to the impact of the war in Ukraine on energy prices, but it is still less severe than in many major economies.

Prime Minister Fumio Kishida announced Thursday that the government will use 3.5 trillion yen ($24 billion) of reserve funds to address the domestic impact of inflation, and will deliver cash relief packages to low-income households.

X.Wong--CPN