-

Sweeping Vietnam internet law comes into force

Sweeping Vietnam internet law comes into force

-

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

Demand for Japanese content booms post 'Shogun'

-

Mystery drones won't interfere with Santa's work: US tracker

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

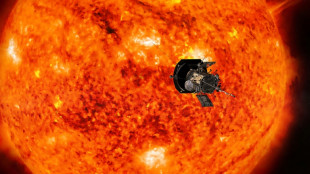

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Trump vows to 'stop transgender lunacy' as a top priority

Trump vows to 'stop transgender lunacy' as a top priority

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Sweet smell of success for niche perfumes

Sweet smell of success for niche perfumes

-

'Finally, we made it!': Ho Chi Minh City celebrates first metro

-

Tunisia women herb harvesters struggle with drought and heat

Tunisia women herb harvesters struggle with drought and heat

-

Trump threatens to take back control of Panama Canal

-

Secretive game developer codes hit 'Balatro' in Canadian prairie province

Secretive game developer codes hit 'Balatro' in Canadian prairie province

-

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

-

Banned Russian skater Valieva stars at Moscow ice gala

Banned Russian skater Valieva stars at Moscow ice gala

-

Biden signs funding bill to avert government shutdown

-

Sorrow and fury in German town after Christmas market attack

Sorrow and fury in German town after Christmas market attack

-

France's most powerful nuclear reactor finally comes on stream

-

Sierra Leone student tackles toxic air pollution

Sierra Leone student tackles toxic air pollution

-

Amazon says US strike caused 'no disruptions'

-

Qualcomm scores key win in licensing dispute with Arm

Qualcomm scores key win in licensing dispute with Arm

-

Scientists observe 'negative time' in quantum experiments

-

US approves first drug treatment for sleep apnea

US approves first drug treatment for sleep apnea

-

Amazon expects no disruptions as US strike goes into 2nd day

-

US confirms billions in chips funds to Samsung, Texas Instruments

US confirms billions in chips funds to Samsung, Texas Instruments

-

Wall Street rebounds despite US inflation ticking higher

ECB unleashes historic rate hike to battle record inflation

The European Central Bank announced the largest rate hike in its history Thursday, as runaway energy prices drove eurozone inflation to new heights.

Policymakers resolved to raise the ECB's key rates by 75 basis points, a leap matched only by a technical move made in 1999 shortly after the central bank's founding.

The "major step" quickened the ECB's move away from a "highly accommodative level of policy rates" to one that would bring inflation back to its two-percent target, it said in a statement.

Eurozone inflation hit a record 9.1 percent in August, as steep increases in the price of energy in the wake of the Russian invasion of Ukraine heaped pressure on households and businesses.

Consumer prices were likely to continue to rise at a very quick pace "for an extended period", the ECB predicted, with its latest forecasts expecting inflation to average 8.1 percent for 2022.

"Given the level of inflation and the uncertainties about its evolution, for the ECB, there is less risk in doing more than in doing less," said Franck Dixmier, head of fixed income at Allianz Global Investors.

The ECB already exceeded expectations at its July meeting with a 50-basis-point increase in interest rates, its first hike in more than a decade.

Thursday's drastic increase was not the end of the ECB's work, however, with the central bank saying it "expects to raise interest rates further" in its next meetings.

- 'Determination' -

Ahead of the meeting, ECB board member Isabel Schnabel called on her colleagues to show "determination" to tame price rises.

Speaking at the annual Jackson Hole central banking symposium at the end of August, Schnabel urged the central bank to respond "more forcefully to the current bout of inflation, even at the risk of lower growth and higher unemployment".

The ECB is playing catch-up with central banks in the United States and Britain, which started raising rates harder and faster in response to inflation.

The 75-basis-point increase matches the largest step taken by the Federal Reserve in its current hiking cycle.

Meanwhile, a weak euro, which fell below $0.99 for the first time in 20 years this week, has bolstered the case for bigger interest rate hikes.

The gathering Thursday also marked the beginning of a new "meeting-by-meeting" approach by the ECB. In July, policymakers scrapped so-called forward guidance, which had limited the ECB's room for manoeuvre, giving them a free hand for more aggressive hikes.

- Recession rising -

In an updated set of economic forecasts, the ECB said it expected inflation to fall back to 5.5 percent in 2023 and 2.3 percent in 2024.

The central bank also slashed its forecast for economic growth in 2023 to 0.9 percent, from its previous prediction of 2.1 percent.

Recent gloomy economic data meant the eurozone was "expected to stagnate later in the year and in the first quarter of 2023", the ECB said.

"Very high energy prices are reducing the purchasing power of people's incomes and, although supply bottlenecks are easing, they are still constraining economic activity," said the bank.

The war in Ukraine was also still weighing on the confidence of businesses and consumers, it added.

With energy prices still soaring unabated and winter approaching, EU economic affairs commissioner Paolo Gentiloni warned Wednesday that the threat of a recession in Europe was "rising".

"We may well be heading into one the most challenging winters in generations," he added.

P.Gonzales--CPN