-

Sweeping Vietnam internet law comes into force

Sweeping Vietnam internet law comes into force

-

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

Demand for Japanese content booms post 'Shogun'

-

Mystery drones won't interfere with Santa's work: US tracker

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

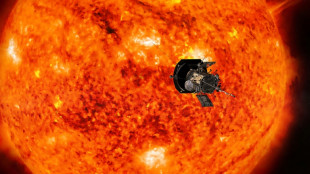

NASA probe makes closest ever pass by the Sun

-

Global stocks mostly rise in thin pre-Christmas trade

Global stocks mostly rise in thin pre-Christmas trade

-

Global stocks mostly rise after US tech rally

-

Investors swoop in to save German flying taxi startup

Investors swoop in to save German flying taxi startup

-

Saving the mysterious African manatee at Cameroon hotspot

-

The tsunami detection buoys safeguarding lives in Thailand

The tsunami detection buoys safeguarding lives in Thailand

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Trump's TikTok love raises stakes in battle over app's fate

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

NASA solar probe to make its closest ever pass of Sun

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Global stock markets edge higher as US inflation eases rate fears

-

US probes China chip industry on 'anticompetitive' concerns

US probes China chip industry on 'anticompetitive' concerns

-

Mobile cinema brings Tunisians big screen experience

-

Honda and Nissan to launch merger talks

Honda and Nissan to launch merger talks

-

Asian markets track Wall St rally as US inflation eases rate fears

-

Honda and Nissan expected to begin merger talks

Honda and Nissan expected to begin merger talks

-

Asian markets track Wall St rally as US inflation eases rate worries

-

Trump vows to 'stop transgender lunacy' as a top priority

Trump vows to 'stop transgender lunacy' as a top priority

-

Beyond Work Unveils Next-Generation Memory-Augmented AI Agent (MATRIX) for Enterprise Document Intelligence

-

Sweet smell of success for niche perfumes

Sweet smell of success for niche perfumes

-

'Finally, we made it!': Ho Chi Minh City celebrates first metro

-

Tunisia women herb harvesters struggle with drought and heat

Tunisia women herb harvesters struggle with drought and heat

-

Trump threatens to take back control of Panama Canal

-

Secretive game developer codes hit 'Balatro' in Canadian prairie province

Secretive game developer codes hit 'Balatro' in Canadian prairie province

-

Stellantis backtracks on plan to lay off 1,100 at US Jeep plant

-

Banned Russian skater Valieva stars at Moscow ice gala

Banned Russian skater Valieva stars at Moscow ice gala

-

Biden signs funding bill to avert government shutdown

-

Sorrow and fury in German town after Christmas market attack

Sorrow and fury in German town after Christmas market attack

-

France's most powerful nuclear reactor finally comes on stream

-

Sierra Leone student tackles toxic air pollution

Sierra Leone student tackles toxic air pollution

-

Amazon says US strike caused 'no disruptions'

-

Qualcomm scores key win in licensing dispute with Arm

Qualcomm scores key win in licensing dispute with Arm

-

Scientists observe 'negative time' in quantum experiments

-

US approves first drug treatment for sleep apnea

US approves first drug treatment for sleep apnea

-

Amazon expects no disruptions as US strike goes into 2nd day

-

US confirms billions in chips funds to Samsung, Texas Instruments

US confirms billions in chips funds to Samsung, Texas Instruments

-

Wall Street rebounds despite US inflation ticking higher

Euro slides as Fed chief steals ECB's rate hike thunder

The euro slid on Thursday despite a record interest rate hike by the European Central Bank as US Fed chief Jerome Powell made hawkish comments.

Meanwhile, the pound remained close to a 37-year low against the dollar that was struck Wednesday, as new British Prime Minister Liz Truss announced that she will freeze domestic fuel bills for two years to help ease the burden of a UK cost-of-living crisis.

The ECB warned Thursday that inflation was "far too high" and likely to stay above target for "an extended period" as it announced its record 0.75 percentage point hike.

ECB chief Christine Lagarde made clear interest rates were far from where they need be to bring inflation down.

"We actually took the decision today that we would continue to raise interest rates... because we believe that we are far away from the rate at which we hope we'll see inflation return to the two percent medium term target," she said.

Lagarde also warned the eurozone risks recession if Russia completely cuts off gas, which it has nearly done.

But comments by Fed chief Jerome Powell were seen as even more hawkish than those by Lagarde.

"We need to act now forthrightly, strongly as we have been doing and we need to keep at it until the job is done to avoid ... the kind of very high social costs" of the surge in inflation in the 1970s and 1980s, Powell told a US think tank.

- Greenback 'more attractive' -

Chris Beauchamp, chief market analyst at online trading platform IG, said "Investors clearly believe that the Fed is more committed to higher rates than the ECB, while the stronger economic performance of the US means the greenback and not the euro seems the more attractive prospect."

The euro, which had broken back above parity with the dollar, slid down as far as $0.9934 before recovering some ground.

The Fed has made it clear it plans to continue to aggressively raise interest rates to rein in surging inflation, even at the cost of causing some economic pain.

The dollar has moved ever higher against its major peers in recent weeks as investors flood into the currency hoping for better returns as the Fed raises rates and as they seek a haven in the face of economic turmoil.

The euro on Wednesday touched a fresh 20-year dollar low.

The US unit is closing in on a 32-year peak against the yen owing to the Bank of Japan's refusal to raise interest rates.

Observers expect the dollar to keep attracting strong interest as long as the Federal Reserve keeps ramping up US interest rates by sizeable amounts.

The Fed holds its next policy meeting on September 21, with a third successive 75-basis-point lift forecast.

In equities trading, eurozone stocks closed the day mostly higher, and Wall Street was also up in morning trading.

"It has been slow going, but stocks look like they are in a mood to continue yesterday’s rebound," said IG's Beauchamp.

"The selling of late August and early September seems to have been exhausted for now, although the broader outlook is still less than encouraging," he added.

- Key figures at around 1530 GMT -

New York - Dow: UP 0.5 percent at 31,736.76 points

EURO STOXX 50: UP 0.3 percent at 3,512.38

London - FTSE 100: UP 0.3 percent at 7,262.06 (close)

Frankfurt - DAX: DOWN less than 0.1 percent at 12,904.32 (close)

Paris - CAC 40: UP 0.3 percent at 6,125.90 (close)

Tokyo - Nikkei 225: UP 2.3 percent at 28,065.28 (close)

Hong Kong - Hang Seng Index: DOWN 1.0 percent at 18,854.62 (close)

Shanghai - Composite: DOWN 0.3 percent at 3,235.59 (close)

Euro/dollar: DOWN at $0.9960 from $1.0012 on Wednesday

Pound/dollar: DOWN at $1.1492 from $1.1535

Euro/pound: DOWN at 86.66 pence from 86.74 pence

Dollar/yen: UP at 143.94 yen from 143.79 yen

West Texas Intermediate: UP 1.7 percent at $83.29 per barrel

Brent North Sea crude: UP 1.0 percent at $88.87 per barrel

burs-rl/cdw

M.García--CPN