-

Greenland to get new government to lead independence process

Greenland to get new government to lead independence process

-

Stocks diverge over Trump tariffs, Ukraine ceasefire plan

-

Battery maker Northvolt files for bankruptcy in Sweden

Battery maker Northvolt files for bankruptcy in Sweden

-

Markets mixed as Trump trade policy sows uncertainty

-

'Stranded' astronauts closer to coming home after next ISS launch

'Stranded' astronauts closer to coming home after next ISS launch

-

Thailand sacks senior cop over illicit gambling, fraud

-

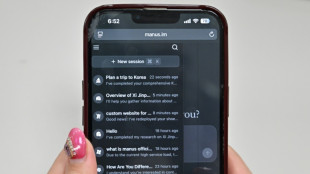

What to know about Manus, China's latest AI assistant

What to know about Manus, China's latest AI assistant

-

US tariffs of 25% on steel, aluminum imports take effect

-

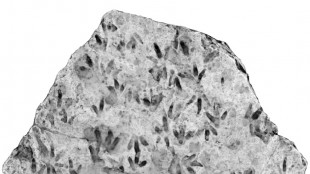

Trove of dinosaur footprints found at Australian school

Trove of dinosaur footprints found at Australian school

-

Rubio heads to Canada as Trump wages trade war

-

Most Asian stocks drop as Trump trade policy sows uncertainty

Most Asian stocks drop as Trump trade policy sows uncertainty

-

Morocco fights measles outbreak amid vaccine misinformation

-

Trump talks up Tesla in White House show of support for Musk

Trump talks up Tesla in White House show of support for Musk

-

Oil companies greet Trump return, muted on tariffs

-

Trump burnishes Tesla at White House in show of support for Musk

Trump burnishes Tesla at White House in show of support for Musk

-

Italian defence firm Leonardo to focus on int'l alliances for growth

-

Stock markets extend losses over US tariffs, recession fears

Stock markets extend losses over US tariffs, recession fears

-

Trump doubles down on Canada trade war with major tariff hike

-

UK makes manslaughter arrest over North Sea ship crash

UK makes manslaughter arrest over North Sea ship crash

-

Ghana scraps IMF-linked 'nuisance' taxes

-

Trump doubles down on Canada trade war with massive new tariffs

Trump doubles down on Canada trade war with massive new tariffs

-

French right-wing media's Russia tilt irks Elysee

-

Stock markets waver after sell-off over US recession fears

Stock markets waver after sell-off over US recession fears

-

Volkswagen to navigate another tricky year after 2024 profit plunge

-

Ships blaze after North Sea crash, govt rules out foul play

Ships blaze after North Sea crash, govt rules out foul play

-

Chanel plays with proportions as Paris Fashion Week wraps up

-

Stock markets mixed as Trump-fuelled economy fears weigh

Stock markets mixed as Trump-fuelled economy fears weigh

-

Ships blaze, spill feared after North Sea crash

-

Volkswagen profits hit as high costs, China woes weigh

Volkswagen profits hit as high costs, China woes weigh

-

Struggling Japanese automaker Nissan replaces CEO

-

Ships still on fire after North Sea crash

Ships still on fire after North Sea crash

-

Lego posts record profit, CEO shrugs off US tariff threat

-

Most markets in retreat as Trump-fuelled economy fears build

Most markets in retreat as Trump-fuelled economy fears build

-

Asian markets track Wall St lower as Trump-fuelled economy fears build

-

From 'mob wives' to millennials: Faux fur is now a fashion staple

From 'mob wives' to millennials: Faux fur is now a fashion staple

-

South Korea's Kia denies responsibility for anti-Musk ad

-

Kung fu girl group puts fresh spin on ancient Chinese art

Kung fu girl group puts fresh spin on ancient Chinese art

-

Asian markets track Wall St selloff as Trump-fuelled economy fears build

-

Indian artisans keep traditional toymaking alive

Indian artisans keep traditional toymaking alive

-

Bear Robotics' Carti 100 Wins iF DESIGN AWARD 2025, Setting New Standards in Logistics Automation

-

Formerra Introduces Formerra+ Upgraded Ecommerce Site to Optimize Customer Experience

Formerra Introduces Formerra+ Upgraded Ecommerce Site to Optimize Customer Experience

-

Search ends for missing crew member after North Sea collision

-

One missing after cargo ship, tanker collide in North Sea

One missing after cargo ship, tanker collide in North Sea

-

Stock markets slump on US recession fears

-

'Elbows up!' - the hockey tactic inspiring Canada's anti-Trump fight

'Elbows up!' - the hockey tactic inspiring Canada's anti-Trump fight

-

Argentina searches for baby, young sister swept away by floods

-

Stock markets slump on US economic fears

Stock markets slump on US economic fears

-

UN chief says 'poison of patriarchy' is back with a vengeance

-

UBS fined 75,000 euros in France for harassing two whistleblowers

UBS fined 75,000 euros in France for harassing two whistleblowers

-

Stock markets slump on US, China economic fears

US inflation likely eased in August -- but not enough

US inflation likely slowed in August, largely thanks to falling gasoline prices, but not enough to satisfy policymakers, especially President Joe Biden, as high prices continue to inflict pain on American families and businesses.

The consumer price index (CPI), a key measure of inflation, is expected to have fallen in August compared to the prior month -- the first decline since November 2020. The Labor Department is due to release the latest data Tuesday.

The annual inflation pace also is likely to have improved to 8.0 percent, according to a MarketWatch consensus forecast, from the blistering 9.1 percent rate in June -- the highest in 40 years.

Prices have been soaring for months, exacerbated by the Russian invasion of Ukraine, which has impacted energy and food prices, as well as ongoing supply chain snarls amid Covid lockdowns in China.

While Americans will welcome relief at the pump, from the steady drop in gasoline prices, high costs for food and housing continue to strain family budgets.

"Risks remain skewed to the upside, due to an uncertain outlook for key inputs, including agricultural and energy commodities, as well as the pass-through of wage gains in a tight labor market," according to Barclays US analysts Pooja Sriram and Jonathan Hill.

They project a one percent increase in food prices in the month, with housing up 0.6 percent.

Inflation also has become a hot political issue just weeks away from key midterm congressional elections, and Biden has made fighting high prices his top domestic priority, so any relief will be welcomed at the White House.

"Inflation is way too high, and it's essential that we bring it down," Treasury Secretary Janet Yellen said Sunday, echoing a comment she and other administration officials have made repeatedly to show their sympathy with the plight faced by consumers and firms.

- Recession risk -

The Federal Reserve views inflation as the biggest risk to the world's largest economy, and has moved aggressively to cool demand, increasing the benchmark lending rate four times this year, with a third consecutive three-quarter point hike widely expected next week.

The Fed actions increase the cost of borrowing for homebuyers and businesses, which tends to cool investment and spending.

Fed Chair Jerome Powell has said the central bank will do whatever it takes to ensure high prices do not become entrenched, even at the risk of tipping the economy into a recession.

"The clock is ticking," Powell warned Friday, pledging to "keep at it until the job is done."

Yellen acknowledged that there is "certainly a risk" of an economic downturn amid the rising lending costs, but she noted the US job market is "exceptionally strong" with nearly two vacancies for every worker looking for a job.

And she cautioned that "we can't have a strong labor market without inflation under control."

Fed officials have said they are encouraged by easing price pressures, but not satisfied. A survey released Monday by the New York Federal Reserve Bank showed consumer inflation expectations fell sharply in August.

The strong job market -- the unemployment rate was 3.7 percent in August -- also provides some comfort, giving policymakers room to maneuver, and potentially quell inflation without a steep increase in joblessness.

But the worker shortage remains a concern since it could fuel a dangerous wage-spiral.

And many economists are skeptical the Fed can achieve the desired "soft-landing."

"It is unlikely, but not impossible," for the Fed to achieve that goal, according to Laurence Ball of Johns Hopkins University and Daniel Leigh and Prachi Mishra of the International Monetary Fund.

In a paper published last week they warned that "the small increase in unemployment the Fed projects won't be enough" to bring inflation down.

M.Anderson--CPN