-

Journalist quits broadcaster after comparing French actions in Algeria to Nazi massacre

Journalist quits broadcaster after comparing French actions in Algeria to Nazi massacre

-

Highlights from Paris Women's Fashion Week

-

US ends waiver for Iraq to buy Iranian electricity

US ends waiver for Iraq to buy Iranian electricity

-

China-US trade war heats up with Beijing's tariffs to take effect

-

Greenland's Inuits rediscover their national pride

Greenland's Inuits rediscover their national pride

-

Floods, mass power cuts as wild weather bashes eastern Australia

-

Wild weather leaves mass blackouts in Australia

Wild weather leaves mass blackouts in Australia

-

China consumption slump deepens as February prices drop

-

Phone bans sweep US schools despite skepticism

Phone bans sweep US schools despite skepticism

-

Some 200 detained after Istanbul Women's Day march: organisers

-

'Grieving': US federal workers thrown into uncertain job market

'Grieving': US federal workers thrown into uncertain job market

-

Remains of murdered Indigenous woman found at Canada landfill

-

Women will overthrow Iran's Islamic republic: Nobel laureate

Women will overthrow Iran's Islamic republic: Nobel laureate

-

Women step into the ring at west African wrestling tournament

-

Trump's tariff rollback brings limited respite as new levies loom

Trump's tariff rollback brings limited respite as new levies loom

-

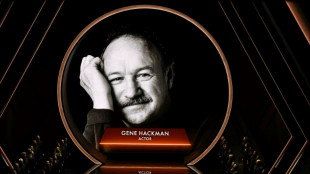

Hackman died of natural causes, a week after wife: medical examiner

-

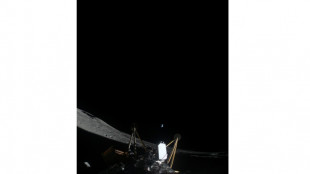

Oops, we tipped it again: Mission over for sideways US lander

Oops, we tipped it again: Mission over for sideways US lander

-

Cyclone Alfred downgraded to tropical low as it nears Australia

-

Global stocks mixed as Trump shifts on tariffs weighs on sentiment

Global stocks mixed as Trump shifts on tariffs weighs on sentiment

-

Trump says dairy, lumber tariffs on Canada may come soon

-

Trump cuts $400 mn from Columbia University over anti-Semitism claims

Trump cuts $400 mn from Columbia University over anti-Semitism claims

-

US Fed chair flags policy uncertainty but in no rush to adjust rates

-

Adopted orphan brings couple 'paradise' in war-ravaged Gaza

Adopted orphan brings couple 'paradise' in war-ravaged Gaza

-

Oops, we tipped it again: Mission over for private US lander

-

Greenland's mining bonanza still a distant promise

Greenland's mining bonanza still a distant promise

-

Pope 'stable' as marks three weeks in hospital with breathless audio message

-

Shares slump on Trump tariffs tinkering, jobs

Shares slump on Trump tariffs tinkering, jobs

-

Mission over for private US lander after wonky landing

-

Thousands stranded as massive WWII bomb blocks Paris train station

Thousands stranded as massive WWII bomb blocks Paris train station

-

UK court cuts longest jail terms on activists, rejects 10 appeals

-

US hiring misses expectations in February as jobs market faces pressure

US hiring misses expectations in February as jobs market faces pressure

-

S.Sudan heatwave 'more likely' due to climate change: study

-

US company says Moon mission over after landing sideways again

US company says Moon mission over after landing sideways again

-

Trump says farmers keen to quit 'terrible' S. Africa welcome in US

-

US stock markets rise as investors track Trump tariffs, jobs

US stock markets rise as investors track Trump tariffs, jobs

-

US hiring misses expectations in February, jobs market sees pressure

-

Disco, reggae on King Charles's 'eclectic' Apple playlist

Disco, reggae on King Charles's 'eclectic' Apple playlist

-

Australian casino firm strikes deal to avoid liquidity crunch

-

Deposed king's grandson makes low-key return to Egypt

Deposed king's grandson makes low-key return to Egypt

-

Stock markets, bitcoin down as Trump policies roil markets

-

Bangladesh student leader aims to finish what uprising began

Bangladesh student leader aims to finish what uprising began

-

Japan, Britain stress free trade in Tokyo talks

-

Spain targets men's 'deafening silence' in gender violence battle

Spain targets men's 'deafening silence' in gender violence battle

-

Spain under pressure to abort nuclear energy phase-out

-

Hungary femicide sparks outcry on gender violence

Hungary femicide sparks outcry on gender violence

-

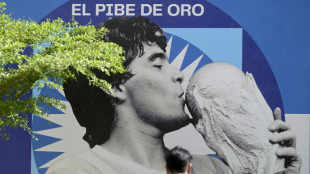

Trial of Maradona's medics to start four years after star's death

-

Women spearhead maternal health revolution in Bangladesh

Women spearhead maternal health revolution in Bangladesh

-

Apple step closer to seeing end of Indonesia iPhone sales ban

-

China's exports start year slow as US trade war intensifies

China's exports start year slow as US trade war intensifies

-

Asian stocks, bitcoin down as trade uncertainty roils markets

Germany reaches deal to nationalise troubled gas giant Uniper

Germany has reached a deal to nationalise troubled gas giant Uniper, the government said Wednesday, as the energy sector reels from the fallout of Russia's war in Ukraine.

Berlin and Uniper's Finnish owner, Fortum, announced a deal that will leave Germany with a 98.5 percent stake in the debt-laden gas company.

"Uniper is a central pillar of German energy supplies," the economy ministry said in a statement.

Under the agreement, Berlin will inject eight billion euros ($8 billion) in cash in Uniper and buy Fortum's shares for 500 million euros.

Fortum will also be repaid for an eight-billion-euro loan it gave Uniper.

"Under the current circumstances in the European energy markets and recognising the severity of Uniper's situation, the divestment of Uniper is the right step to take, not only for Uniper but also for Fortum," said Fortum chief executive Markus Rauramo.

"The role of gas in Europe has fundamentally changed since Russia attacked Ukraine, and so has the outlook for a gas-heavy portfolio. As a result, the business case for an integrated group is no longer viable," Rauramo said in a statement.

One of the biggest importers of Russian gas, Uniper has been squeezed as Moscow has reduced supplies to the continent in the wake of its invasion of Ukraine in February.

Missing deliveries have had to be replaced with expensive supplies from the open market, where prices for gas have skyrocketed.

Fortum said Uniper has accumulated close to 8.5 billion euros in gas-related losses "and cannot continue to fulfil its role as a critical provider of security of supply as a privately-owned company".

- Germany's Russian gas dependence -

The German state had already agreed in July to take a 30 percent stake in Uniper as part of an initial bailout agreement.

But Uniper announced earlier this month that the two sides were exploring a possible nationalisation as the energy crisis showed no signs of abating.

Fortum provided an eight-billion-euro loan to Uniper in January as the price of gas had already begun to climb amid tensions with Moscow before the invasion of Ukraine.

The Finnish company held a near-80-percent stake in Uniper, which would have been cut to around 56 percent under the July bailout plan.

Earlier in September, the German government entered into discussions with another gas supplier, VNG, over a possible bailout package.

Russia's war in Ukraine has triggered an earthquake on European energy markets, cranked up the pressure on suppliers and raised fears of possible shortages over the winter.

Germany has found itself particularly exposed due to its previous heavy reliance on Russian energy imports.

Since the outbreak of the war, Berlin has worked to wean itself off Russian gas and secure alternative supplies.

Officials have seized key pieces of energy infrastructure which were in the hands of Russian energy companies and mandated gas stores to be filled.

Ch.Lefebvre--CPN