-

Stock markets slump on US, China economic fears

Stock markets slump on US, China economic fears

-

Major fuel shortage hits black gold producer Niger

-

Musk spat renews opposition in Italy to Starlink deal

Musk spat renews opposition in Italy to Starlink deal

-

Stock markets mainly lower on China, US economy fears

-

Former Ubisoft bosses on trial in France over alleged harassment

Former Ubisoft bosses on trial in France over alleged harassment

-

Strike action grounds thousands of flights in Germany

-

Trump says US in talks with four groups over TikTok sale

Trump says US in talks with four groups over TikTok sale

-

Hong Kong, Shanghai lead losers on mixed day for markets

-

'Got cash?' Tunisians grapple with new restrictions on cheques

'Got cash?' Tunisians grapple with new restrictions on cheques

-

Russian disinformation 'infects' AI chatbots, researchers warn

-

'Quite sad': Renters turn to lottery in Spain's housing crisis

'Quite sad': Renters turn to lottery in Spain's housing crisis

-

Indonesians seek escape as anger rises over quality of life

-

Iran says won't negotiate under 'intimidation' as Trump ramps up pressure

Iran says won't negotiate under 'intimidation' as Trump ramps up pressure

-

7-Eleven, Couche-Tard explore sell-offs ahead of potential merger

-

Trump admin detains pro-Palestinian campus protest leader

Trump admin detains pro-Palestinian campus protest leader

-

Japan auctions emergency rice reserves as prices soar

-

Hong Kong, Shanghai lead losers on mixed day for Asian markets

Hong Kong, Shanghai lead losers on mixed day for Asian markets

-

China-US trade war heats up as Beijing's tariffs take effect

-

7-Eleven to explore sell-offs with Couche-Tard ahead of potential merger

7-Eleven to explore sell-offs with Couche-Tard ahead of potential merger

-

'So important': Selma marks 60 years since US civil rights march

-

Black comedy from award-winning 'Parasite' director tops N.America box office

Black comedy from award-winning 'Parasite' director tops N.America box office

-

EU chief sees US as 'allies' despite 'differences'

-

French research groups urged to welcome scientists fleeing US

French research groups urged to welcome scientists fleeing US

-

Journalist quits broadcaster after comparing French actions in Algeria to Nazi massacre

-

Highlights from Paris Women's Fashion Week

Highlights from Paris Women's Fashion Week

-

US ends waiver for Iraq to buy Iranian electricity

-

China-US trade war heats up with Beijing's tariffs to take effect

China-US trade war heats up with Beijing's tariffs to take effect

-

Greenland's Inuits rediscover their national pride

-

Floods, mass power cuts as wild weather bashes eastern Australia

Floods, mass power cuts as wild weather bashes eastern Australia

-

Wild weather leaves mass blackouts in Australia

-

China consumption slump deepens as February prices drop

China consumption slump deepens as February prices drop

-

Phone bans sweep US schools despite skepticism

-

Some 200 detained after Istanbul Women's Day march: organisers

Some 200 detained after Istanbul Women's Day march: organisers

-

'Grieving': US federal workers thrown into uncertain job market

-

Remains of murdered Indigenous woman found at Canada landfill

Remains of murdered Indigenous woman found at Canada landfill

-

Women will overthrow Iran's Islamic republic: Nobel laureate

-

Women step into the ring at west African wrestling tournament

Women step into the ring at west African wrestling tournament

-

Trump's tariff rollback brings limited respite as new levies loom

-

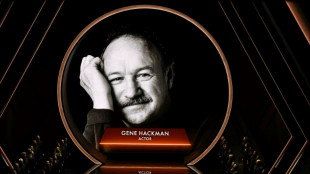

Hackman died of natural causes, a week after wife: medical examiner

Hackman died of natural causes, a week after wife: medical examiner

-

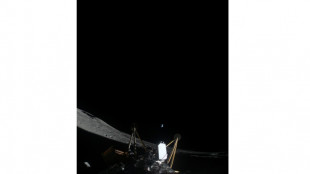

Oops, we tipped it again: Mission over for sideways US lander

-

Cyclone Alfred downgraded to tropical low as it nears Australia

Cyclone Alfred downgraded to tropical low as it nears Australia

-

Global stocks mixed as Trump shifts on tariffs weighs on sentiment

-

Trump says dairy, lumber tariffs on Canada may come soon

Trump says dairy, lumber tariffs on Canada may come soon

-

Trump cuts $400 mn from Columbia University over anti-Semitism claims

-

US Fed chair flags policy uncertainty but in no rush to adjust rates

US Fed chair flags policy uncertainty but in no rush to adjust rates

-

Adopted orphan brings couple 'paradise' in war-ravaged Gaza

-

Oops, we tipped it again: Mission over for private US lander

Oops, we tipped it again: Mission over for private US lander

-

Greenland's mining bonanza still a distant promise

-

Pope 'stable' as marks three weeks in hospital with breathless audio message

Pope 'stable' as marks three weeks in hospital with breathless audio message

-

Shares slump on Trump tariffs tinkering, jobs

Stocks stabilise as pound rebounds

Equity markets stabilised Tuesday after recent volatility, as the dollar weakened slightly against major rivals, helping the pound to rebound from a record low.

Shares in Paris, Frankfurt and London pushed higher in mid-afternoon trading, as investors track central bank moves aimed at tackling soaring inflation.

Wall Street stocks also climbed, rallying after several losing sessions that analysts have said left the market "oversold" in the short term.

Recession prospects have risen in recent weeks as central banks keep hiking interest rates to try and cool decades-high inflation, boosting in particular the dollar.

In the latest warning of a looming economic downturn, World Trade Organization chief Ngozi Okonjo-Iweala said Tuesday that the world was heading towards a global recession as multiple crises collide.

The Federal Reserve has carried out three successive bumper US hikes and is warning of more to come.

That has seen investors pile into the dollar, sending it to record or multi-decade peaks, in turn rattling governments from Tokyo to Beijing and London.

On Monday, the pound hit an all-time low at $1.0350, with traders spooked by a UK tax giveaway they warned could further fuel inflation and significantly ramp up British state borrowing.

"Dollar strength remains the driving force -- or wrecking ball -- in financial markets at the moment," said Markets.com analyst Neil Wilson.

Sterling staged a small recovery Tuesday after the Bank of England said it would "not hesitate to change interest rates by as much as needed".

With the pound showing record weakness against the dollar this week, analysts are forecasting a big rate increase when the BoE holds its next regular policy meeting on November 3.

"A rate hike of over 150 basis points is currently priced in for the coming meeting," Commerzbank analyst Esther Reichelt noted Tuesday, questioning if that would even be enough.

The Bank of England's statement "is unlikely to calm all those who had already questioned the BoE's determination to fight inflation even prior to these events", she added.

- Gas, oil -

Elsewhere, European natural gas prices surged nearly 10 percent to 190.50 euros following news that the two Nord Stream gas pipelines linking Russia and Europe have been hit by unexplained leaks, raising suspicions of sabotage.

The pipelines have been at the centre of geopolitical tensions in recent months as Russia cut gas supplies to Europe in suspected retaliation against Western sanctions following its invasion of Ukraine.

"This damage is the clearest signal so far that Europe will have to survive the winter without significant Russian gas flows," analysts at Charles Schwab said in a note to clients.

A major new pipeline that will bring in Norwegian gas via Denmark was inaugurated in Poland on Tuesday in a move aimed at helping strengthen Europe's energy security.

Oil prices jumped more than two percent, helped by a weaker dollar.

"Oil remains a sellers’ market with worries about a global recession and high interest rates intensifying," Fawad Razaqzada, analyst at City Index and FOREX.com said.

"In addition, with currencies of major oil importing nations tumbling, anything traded in US dollars will cost more... such as oil."

- Key figures at around 1350 GMT -

London - FTSE 100: UP 0.2 percent at 7,036.62 points

Frankfurt - DAX: UP 0.4 percent at 12,276.85

Paris - CAC 40: UP 0.6 percent at 5,798.37

EURO STOXX 50: UP 0.4 percent at 3,356.97

New York - Dow: UP 1.0 percent at 29,552.47

Tokyo - Nikkei 225: UP 0.5 percent at 26,571.87 (close)

Hong Kong - Hang Seng Index: FLAT at 17,860.31 (close)

Shanghai - Composite: UP 1.4 percent at 3,093.86 (close)

Pound/dollar: UP at $1.0766 from $1.0689 on Monday

Euro/dollar: UP at $0.9635 from $0.9611

Euro/pound: DOWN at 89.41 pence from 89.87 pence

Dollar/yen: DOWN at 144.61 yen from 144.72 yen

Brent North Sea crude: UP 2.5 percent at $86.13 per barrel

West Texas Intermediate: UP 2.4 percent at $78.51 per barrel

A.Leibowitz--CPN