-

Stock markets slump on US, China economic fears

Stock markets slump on US, China economic fears

-

Major fuel shortage hits black gold producer Niger

-

Musk spat renews opposition in Italy to Starlink deal

Musk spat renews opposition in Italy to Starlink deal

-

Stock markets mainly lower on China, US economy fears

-

Former Ubisoft bosses on trial in France over alleged harassment

Former Ubisoft bosses on trial in France over alleged harassment

-

Strike action grounds thousands of flights in Germany

-

Trump says US in talks with four groups over TikTok sale

Trump says US in talks with four groups over TikTok sale

-

Hong Kong, Shanghai lead losers on mixed day for markets

-

'Got cash?' Tunisians grapple with new restrictions on cheques

'Got cash?' Tunisians grapple with new restrictions on cheques

-

Russian disinformation 'infects' AI chatbots, researchers warn

-

'Quite sad': Renters turn to lottery in Spain's housing crisis

'Quite sad': Renters turn to lottery in Spain's housing crisis

-

Indonesians seek escape as anger rises over quality of life

-

Iran says won't negotiate under 'intimidation' as Trump ramps up pressure

Iran says won't negotiate under 'intimidation' as Trump ramps up pressure

-

7-Eleven, Couche-Tard explore sell-offs ahead of potential merger

-

Trump admin detains pro-Palestinian campus protest leader

Trump admin detains pro-Palestinian campus protest leader

-

Japan auctions emergency rice reserves as prices soar

-

Hong Kong, Shanghai lead losers on mixed day for Asian markets

Hong Kong, Shanghai lead losers on mixed day for Asian markets

-

China-US trade war heats up as Beijing's tariffs take effect

-

7-Eleven to explore sell-offs with Couche-Tard ahead of potential merger

7-Eleven to explore sell-offs with Couche-Tard ahead of potential merger

-

'So important': Selma marks 60 years since US civil rights march

-

Black comedy from award-winning 'Parasite' director tops N.America box office

Black comedy from award-winning 'Parasite' director tops N.America box office

-

EU chief sees US as 'allies' despite 'differences'

-

French research groups urged to welcome scientists fleeing US

French research groups urged to welcome scientists fleeing US

-

Journalist quits broadcaster after comparing French actions in Algeria to Nazi massacre

-

Highlights from Paris Women's Fashion Week

Highlights from Paris Women's Fashion Week

-

US ends waiver for Iraq to buy Iranian electricity

-

China-US trade war heats up with Beijing's tariffs to take effect

China-US trade war heats up with Beijing's tariffs to take effect

-

Greenland's Inuits rediscover their national pride

-

Floods, mass power cuts as wild weather bashes eastern Australia

Floods, mass power cuts as wild weather bashes eastern Australia

-

Wild weather leaves mass blackouts in Australia

-

China consumption slump deepens as February prices drop

China consumption slump deepens as February prices drop

-

Phone bans sweep US schools despite skepticism

-

Some 200 detained after Istanbul Women's Day march: organisers

Some 200 detained after Istanbul Women's Day march: organisers

-

'Grieving': US federal workers thrown into uncertain job market

-

Remains of murdered Indigenous woman found at Canada landfill

Remains of murdered Indigenous woman found at Canada landfill

-

Women will overthrow Iran's Islamic republic: Nobel laureate

-

Women step into the ring at west African wrestling tournament

Women step into the ring at west African wrestling tournament

-

Trump's tariff rollback brings limited respite as new levies loom

-

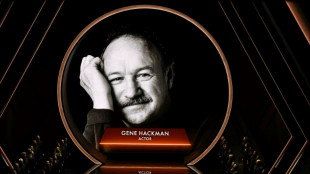

Hackman died of natural causes, a week after wife: medical examiner

Hackman died of natural causes, a week after wife: medical examiner

-

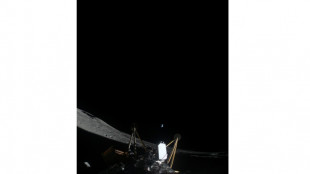

Oops, we tipped it again: Mission over for sideways US lander

-

Cyclone Alfred downgraded to tropical low as it nears Australia

Cyclone Alfred downgraded to tropical low as it nears Australia

-

Global stocks mixed as Trump shifts on tariffs weighs on sentiment

-

Trump says dairy, lumber tariffs on Canada may come soon

Trump says dairy, lumber tariffs on Canada may come soon

-

Trump cuts $400 mn from Columbia University over anti-Semitism claims

-

US Fed chair flags policy uncertainty but in no rush to adjust rates

US Fed chair flags policy uncertainty but in no rush to adjust rates

-

Adopted orphan brings couple 'paradise' in war-ravaged Gaza

-

Oops, we tipped it again: Mission over for private US lander

Oops, we tipped it again: Mission over for private US lander

-

Greenland's mining bonanza still a distant promise

-

Pope 'stable' as marks three weeks in hospital with breathless audio message

Pope 'stable' as marks three weeks in hospital with breathless audio message

-

Shares slump on Trump tariffs tinkering, jobs

| RBGPF | 0% | 66.43 | $ | |

| SCS | -0.47% | 11.675 | $ | |

| NGG | 2.53% | 62.41 | $ | |

| JRI | 0.89% | 12.865 | $ | |

| CMSC | 0.02% | 23.115 | $ | |

| AZN | -1.15% | 76.62 | $ | |

| RYCEF | -5.53% | 9.77 | $ | |

| BCC | 0.33% | 101.952 | $ | |

| GSK | 1.11% | 40.5 | $ | |

| RELX | -0.96% | 47.643 | $ | |

| RIO | 0.43% | 62.58 | $ | |

| BCE | 1.93% | 25.287 | $ | |

| VOD | 0.69% | 9.485 | $ | |

| BP | 0.83% | 32.34 | $ | |

| CMSD | -0.15% | 23.295 | $ | |

| BTI | -0.22% | 40.81 | $ |

India's Adani briefly listed as world's second-richest person

Indian industrialist Gautam Adani briefly became the world's second-richest person on the Forbes real-time billionaire tracker on Friday, weeks after becoming the first Asian to break into the top three.

The self-made billionaire's net worth surged $4 billion overnight to $154 billion, according to Forbes, ranking him ahead of LVMH's Bernard Arnault and Amazon's Jeff Bezos.

Tesla founder Elon Musk remained well out in front with a fortune of more than $270 billion.

Arnault -- who at times held the top spot in May 2021 -- and Adani traded the number two position during the day as the share prices of their companies fluctuated.

Adani, 60, made his fortune in ports and commodities trading and now operates India's second-largest conglomerate with interests ranging from coal mining and edible oils to airports and news media.

His ballooning net worth reflects a stratospheric rise in the market capitalisation of his publicly listed companies, as investors back the Adani Group's aggressive expansion of old and new businesses.

Shares in the flagship Adani Enterprises -- of which the billionaire owns 75 percent -- have soared more than 2,700 percent since March 2020, and doubled in value in the past six months.

Stock price surges in other group companies including Adani Transmission, Adani Power, Adani Ports and Adani Green Energy catapulted Adani past fellow Indian billionaire Mukesh Ambani this year.

Analyst estimates indicated the market capitalisation of Adani's seven listed companies also briefly overtook those of the Tata group on Friday morning, making the Adani Group India's largest conglomerate.

Born in the city of Ahmedabad in the western state of Gujarat to a middle-class family, Adani dropped out of college to work in the diamond industry before starting his export business in 1988.

In 1995, he won a contract to build and operate a commercial shipping port at Mundra in Gujarat, which has since grown to become India's largest port.

At the same time, Adani expanded into thermal power generation and coal mining in India and overseas.

In recent years, the conglomerate has forayed into petrochemicals, cement, data centres and copper refining, in addition to establishing a renewable energy business with ambitious targets.

Recent investments in Indian news media and a bid for 5G airwaves this year have raised speculation that the billionaire's empire could soon impinge on sectors dominated by Ambani's Reliance Industries.

But Adani's rapid expansion into capital-intensive businesses has also raised financial alarms, with Fitch Group's CreditSights last week reiterating that they "remain concerned over the Adani Group's leverage".

D.Goldberg--CPN