-

Kenya's economy faces climate change risks: World Bank

Kenya's economy faces climate change risks: World Bank

-

Campaigning starts in Central African Republic quadruple election

-

'Stop the slaughter': French farmers block roads over cow disease cull

'Stop the slaughter': French farmers block roads over cow disease cull

-

First urban cable car unveiled outside Paris

-

Why SpaceX IPO plan is generating so much buzz

Why SpaceX IPO plan is generating so much buzz

-

US unseals warrant for tanker seized off Venezuelan coast

-

World stocks mostly slide, consolidating Fed-fuelled gains

World stocks mostly slide, consolidating Fed-fuelled gains

-

Crypto firm Tether bids for Juventus, is quickly rebuffed

-

UK's king shares 'good news' that cancer treatment will be reduced in 2026

UK's king shares 'good news' that cancer treatment will be reduced in 2026

-

Can Venezuela survive US targeting its oil tankers?

-

Salah admired from afar in his Egypt home village as club tensions swirl

Salah admired from afar in his Egypt home village as club tensions swirl

-

World stocks retrench, consolidating Fed-fuelled gains

-

Iran frees child bride sentenced to death over husband's killing: activists

Iran frees child bride sentenced to death over husband's killing: activists

-

World stocks consolidate Fed-fuelled gains

-

France updates net-zero plan, with fossil fuel phaseout

France updates net-zero plan, with fossil fuel phaseout

-

Stocks rally in wake of Fed rate cut

-

EU agrees recycled plastic targets for cars

EU agrees recycled plastic targets for cars

-

British porn star to be deported from Bali after small fine

-

British porn star fined, faces imminent Bali deportation

British porn star fined, faces imminent Bali deportation

-

Spain opens doors to descendants of Franco-era exiles

-

Indonesia floods were 'extinction level' for rare orangutans

Indonesia floods were 'extinction level' for rare orangutans

-

Thai teacher finds 'peace amidst chaos' painting bunker murals

-

Japan bear victim's watch shows last movements

Japan bear victim's watch shows last movements

-

South Korea exam chief quits over complaints of too-hard tests

-

French indie 'Clair Obscur' dominates Game Awards

French indie 'Clair Obscur' dominates Game Awards

-

South Korea exam chief resigns after tests dubbed too hard

-

Asian markets track Wall St record after Fed cut

Asian markets track Wall St record after Fed cut

-

Laughing about science more important than ever: Ig Nobel founder

-

Vaccines do not cause autism: WHO

Vaccines do not cause autism: WHO

-

Crypto mogul Do Kwon sentenced to 15 years for fraud: US media

-

'In her prime': Rare blooming of palm trees in Rio

'In her prime': Rare blooming of palm trees in Rio

-

Make your own Mickey Mouse clip - Disney embraces AI

-

OpenAI beefs up GPT models in AI race with Google

OpenAI beefs up GPT models in AI race with Google

-

Dark, wet, choppy: Machado's secret sea escape from Venezuela

-

Cyclone causes blackout, flight chaos in Brazil's Sao Paulo

Cyclone causes blackout, flight chaos in Brazil's Sao Paulo

-

2024 Eurovision winner Nemo returns trophy over Israel's participation

-

US bringing seized tanker to port, as Venezuela war threats build

US bringing seized tanker to port, as Venezuela war threats build

-

Make your own AI Mickey Mouse - Disney embraces new tech

-

Time magazine names 'Architects of AI' as Person of the Year

Time magazine names 'Architects of AI' as Person of the Year

-

Floodworks on Athens 'oasis' a tough sell among locals

-

OpenAI, Disney to let fans create AI videos in landmark deal

OpenAI, Disney to let fans create AI videos in landmark deal

-

German growth forecasts slashed, Merz under pressure

-

Thyssenkrupp pauses steel production at two sites citing Asian pressure

Thyssenkrupp pauses steel production at two sites citing Asian pressure

-

ECB proposes simplifying rules for banks

-

Stocks mixed as US rate cut offset by Fed outlook, Oracle earnings

Stocks mixed as US rate cut offset by Fed outlook, Oracle earnings

-

Desert dunes beckon for Afghanistan's 4x4 fans

-

Breakout star: teenage B-girl on mission to show China is cool

Breakout star: teenage B-girl on mission to show China is cool

-

Chocolate prices high before Christmas despite cocoa fall

-

Austria set to vote on headscarf ban in schools

Austria set to vote on headscarf ban in schools

-

Asian traders cheer US rate cut but gains tempered by outlook

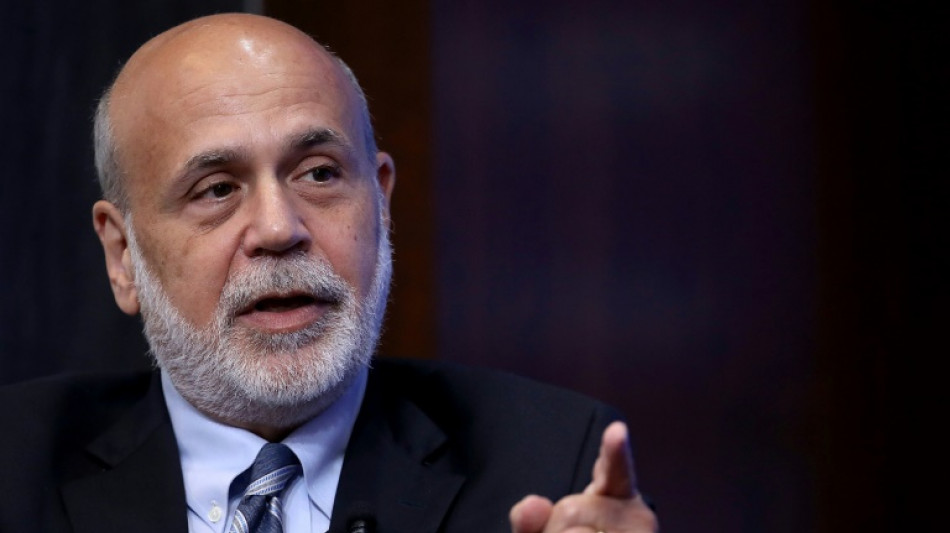

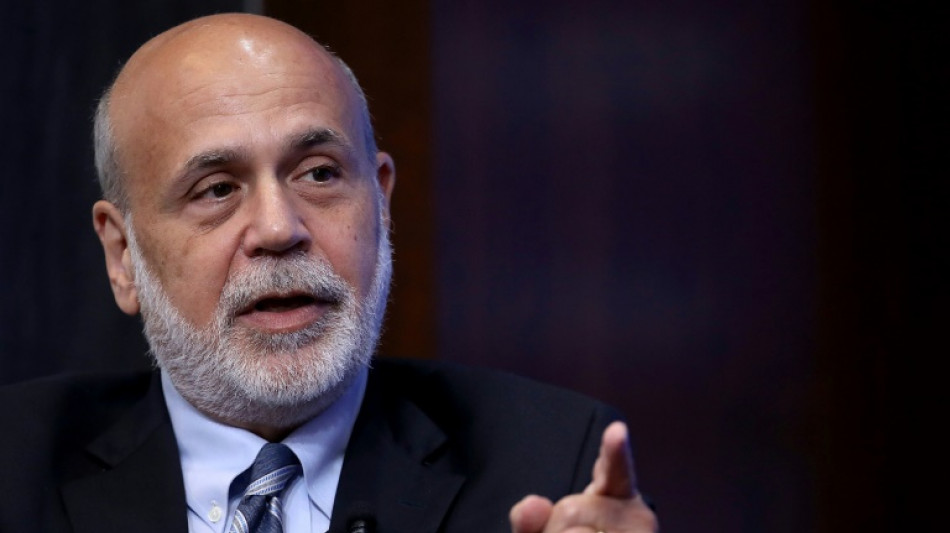

Bernanke: Depression scholar who faced global financial crisis

Ben Bernanke, who shared the Nobel Economics Prize on Monday, is a scholar of the Great Depression who helped to steer the United States through another major financial crisis as Federal Reserve chief.

Bernanke took over as Fed chair in February 2006, just before the collapse of the US housing market that triggered a global crisis of epic proportions.

Many analysts say Bernanke's aggressive and unorthodox moves allowed the central bank to prop up the financial system and keep credit flowing, therefore avoiding a repeat of a 1930s-style calamity.

His critics, though, argue that he did little to avert the crisis and may have helped fuel the problems when he was a Fed governor in 2002-2005 under then-chairman Alan Greenspan and subsequently headed the Council of Economic Advisers under former president George W. Bush.

The Nobel jury awarded the prize to Bernanke, 68, along with fellow US economists Douglas Diamond and Philip Dybvig for having "significantly improved our understanding of the role of banks in the economy, particularly during financial crises, as well as how to regulate financial markets."

Bernanke was singled out for his analysis of "the worst economic crisis in modern history" -- the Great Depression in the 1930s. He published a book on his essays about the topic and co-authored another about the 2008 financial crisis.

He is now a senior fellow at the Brookings Institution think tank in Washington and a senior adviser to the asset management firms Pimco and Citadel -- appointments that raised concerns about the "revolving door" between Washington and Wall Street.

- 'Creative leadership' -

In recognition for his actions during the global financial crisis, he was named TIME magazine's "Person of the Year" for 2009.

TIME honored the former Princeton University professor as "the most important player guiding the world's most important economy."

"His creative leadership helped ensure that 2009 was a period of weak recovery rather than catastrophic depression," TIME senior writer Michael Grunwald wrote.

Grunwald said at the time that Bernanke still wielded "unrivaled power over our money, our jobs, our savings and our national future."

Bernanke served as central bank chief under Bush and was kept on the job by the Republican leader's Democratic successor, Barack Obama.

The former central banker has stressed the importance of transparency in the Fed's communications, stepping away from Greenspan's turgid, jargon-laden statements.

And unlike his predecessor, Bernanke talked often to reporters.

Joseph Brusuelas, a director at Moody's Analytics, once said that the Fed's unorthodox response to the global financial crisis was "without precedent" as it slashed its policy rate to zero and "flooded the financial system with liquidity."

The Fed's moves, Brusuelas said, "slowly rebuilt confidence in the banking system."

Jeffrey Sachs, economist at Columbia University, said "a depression seemed possible" at the time of the Lehman Brothers collapse in September 2008, but action by central banks "prevented financial markets from crashing."

- Lehman 'blunder' -

But others criticized him for failing to better predict the severity of the economic crisis: in 2007, when the first signs of the subprime mortgage crisis emerged, Bernanke assured Congress that the fallout would be limited.

Others accuse Bernanke of failing to act quickly to cut interest rates once the scale of the crisis emerged. The Fed instead adopted a go-slow posture on cutting rates, before making an emergency cut in January 2008.

Among Bernanke critics, the late economist Allan Meltzer at Carnegie Mellon University said the Lehman collapse represented a mistake of historic proportions.

"Allowing Lehman to fail without warning is one of the worst blunders in Federal Reserve history," he wrote in a Wall Street Journal essay.

Bernanke was born on December 13, 1953 in Augusta, Georgia, to a pharmacist father and a schoolteacher mother. He grew up in a Jewish household, a minority in the heavily Christian community.

He spent his childhood in Dillon, South Carolina -- a farm town with a population of 7,500 -- and was a star scholar, achieving a near-perfect score in the Scholastic Aptitude Test (SAT), a university entrance exam.

He studied economics at Harvard and graduated with top honors in 1975, then went on to obtain a PhD in economics from the Massachusetts Institute of Technology.

He worked at Princeton for 17 years before joining the Federal Reserve Board in 2002.

L.K.Baumgartner--CPN